This happens.

Newer coins are releasing ‘tokens’ so the volume of tokens you can invest in a coin is limited. But some have a good release schedule, others have a poor one. One I was stalking, I held back on because a large lot of tokens was being released, but it was during the US election week so the impact was unnoticeable. Others are released during quiet periods and you can see on the chart that it’s enough for the price to break down or go through a quiet period until it returns.

There is something like thousands of meme coins released daily or weekly. A high majority don’t make it very far. Some break through and find their way onto the more popular exchanges. Others just stay wherever they stay (I don’t concern myself in these ones).

The more important question to ask is, is there enough people buying and selling the coin to counteract the amount that is available? June & July would provide a different answer to November / December. February / March would another different answer. 2026 would provide a different answer to 2025.

Don’t think so.

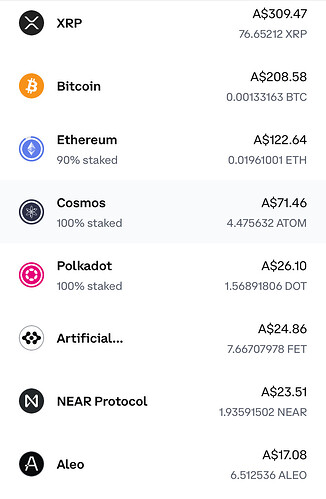

Bitcoin is great for long term as I’ve mentioned. But during specific times, the other coins get far better returns than Bitcoin. So good traders will rotate their investments. Doesn’t mean you sell all your bitcoin and switch to XRP. You just rebalance the portfolio somewhat so you get the consistent gains of bitcoin and the returns from other coins.

Bitcoin has always had a dominant share of the market. I’m not sure what the split is.

It doesn’t really matter as it is the catalyst of the entire crypto market.

It is very rare (not impossible) to find a coin (ignore stable coins) that gives positive gains when bitcoin is floundering after a peak of the cycle. And it is also very rare to find a coin that doesn’t provide negative gains when bitcoin is moving like it is.

A good example is the period between March and September this year. Some coins held their value and actually improved during that time. A high majority of those moved very well as soon as bitcoin moved into all time highs in early November. Some didn’t. ADA, XRP and others were terrible even earlier this year when bitcoin went for a few long walks and doubled its value in six months. But during this move, they had their move across the following 3 weeks after bitcoin moved. But if bitcoin didn’t move the others are unlikely to have those similar moves (not impossible, but unlikely).

Until the cycle along with the higher highs and higher lows ceases to be a thing, I’m fine trading crypto. There will be a cycle where it doesn’t act like previous cycles (every market has one of these for a variety of reasons). It may rebound out of it, it may not. No one knows. That’s what investing is. You are trying to look for signs, statistics, timing, to stack the odds in your favour so that you come out of it all in a profit.

The main difficulty is the volatility of the market. If you can manage your greed, you’ll be fine. Take out parts or be aware of what can happen when the coin breaks down and exit. I’ve been in one coin 3 times over the last 4 months. It has spat me out 4 times. Once for a good gain. The other three times for a small profit. But in each of those buys, there was a time where there were good gains there to be had, but my rules are to let the stop loss do it’s thing. It may move higher (like others) it may not (like others). I’m fine to risk a drawdown for the opportunity to stay in a trade and get the results of something like OM or PEPE. Won’t happen often, but through backtesting, I prefer those results than taking some profits and getting annoyed when it takes off and I’ve taken half off the table. By the end of the cycle it pays itself off. And there’s less manual work for every trade

The hardest thing about trading is working out what type of trading you prefer (short / longterm), what kind of risks are you willing to take, what drawdowns can you actually sit through and how much time and effort are you willing to put into studying and tracking each coin you are investing in as well as the ones you are not. Once you have that sorted out (which can take trial and error), the other stuff (fees, what exchange to use, keep coins on the exchange or cold storage, etc) is relatively simple to deal with in comparison.

The bolded part was the big one for me. Through backtesting, it’s easy to sit through a 30% to 50% drawdown because you know the end result. And the chart goes past six months of trading data for 30 seconds. But sitting through that kind of drawdown for 3 or 4 weeks in real time is a completely different story.

My take FWIW…

I’ve set it up in a way so I can do everything I need to do outside of working hours. Two to three hours per day on my weekends are pretty much filled looking at charts.

I have alerts for certain overnight moves, but don’t ‘get up’ to trade it. It’s just to know what is happening. I don’t do scalping. I prefer longer term trading (weekly and monthly charts). A high majority of the major moves occur overnight, so I need to set my orders and prepare for everything beforehand. Usually, the planning is weeks in advance with lots of patience for a move to occur. There are certain days and nights that I do not like trading so I don’t trade them.

I’m not at a point to quit work, but I am not as reliant on work as I was.

I haven’t been through enough of a cycle to have the different plans for the different stages of a cycle. I have one for now which I have backtested heavily. I have another for the year after the cycle when everything goes down, but I still have to tweak it through backtesting which I aim to do this xmas break. One year is more likely sitting, waiting and observing with a long term view towards the next time things begin to build up again.

There’s a lot of planning involved. And sometimes, that planning doesn’t eventuate (for whatever reason). So you have to learn when to be investing and when not invest depending on your plan or strategy. There isn’t one strategy that works consistently through all phases. Every strategy will have its strengths and weaknesses and you just need to adjust your exposure or the strategy to suit the market conditions and of course whatever you’re willing to take.

Let’s face it, everyone is going to be an expert over the next four to five months. Because the market conditions make it easier to get out of trades with a profit. That is regardless of what narrative anyone wants to produce for a specific coin. The less narratives you get involved in (good or bad) the better you perform. The cycle is the cycle, regardless of the narrative or politics involved. Easier to just follow the charts.

A few historical narratives…

BTC ETF approval will pump the market and price straight away. It didn’t in January this year. That narrative carried the price a particular way but when it actually occurred, BTC went through a correction.

BTC halving will pump the market. Less coin available equals higher prices. It doesn’t happen. The best it’s done during halving is stay relatively stable, but it has reversed around that time.

ETH ETF announcement is going to make ETH be the bitcoin killer. It had its big move on the announcement in May, then gave back 50% for the next two months. It has returned since, but without the narrative.

Follow the chart. Not the narrative.