I’m on a phone but if someone would like to cut and paste this article it would be dandy.

Energy regulator smashes illusion of “cheap” coal power in NSW

By Giles Parkinson on 6 December 2017

The illusion of “cheap” coal power in Australia has been smashed by the Australian Energy Regulator in a report that seeks to absolve the big generators of predatory behaviour, but highlights how the increased cost of coal is making the biggest power source in NSW incredibly expensive.

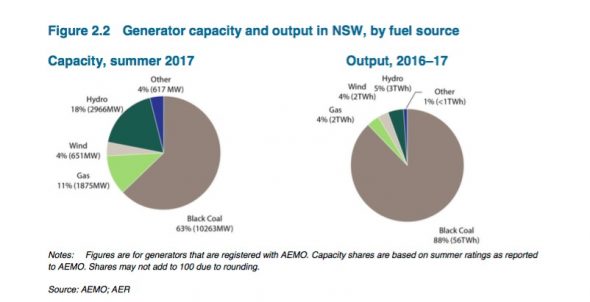

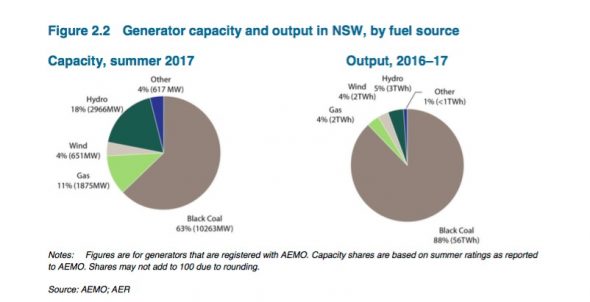

The state of NSW relies on coal possibly more heavily than any other grid in the world: Its five big generators provided 88 per cent of total generation in NSW in 2016/17 (See graph above, on right hand side).

But last summer the state very nearly lost its grip on supply as two big coal units and the two biggest gas units failed in the heat wave – nearly causing the lights to go out were it not for the presence of vast quantities of solar, and some voluntary and not-so voluntary load shedding.

In the wake of the political “crisis” around energy that has been confected by the federal Coalition government this year, the AER was tasked with ongoing monitoring of wholesale prices in NSW on behalf of the COAG energy ministers.

What it found would likely disappoint the Coalition ideologues who like to blame renewable energy at every turn. It turns out that the fault for the near doubling in wholesale electricity prices in NSW in 2017 – from $30-$65/MWh to $80-110/MWh – lies with the cost of the fossil fuels: coal and gas.

The actions of the big fossil fuel generators has come under increased scrutiny since consumers, analysts, smaller retailers, network operators, and state governments accused many of them of deliberately withdrawing capacity and “trading in scarcity” to force up prices.

Much of this has happened in states like South Australia and Queensland, where one or two companies dominate the market. But the AER noted last November how Snowy Hydro and Origin had conspired to force a huge surge in market prices by using bidding behaviours to create scarcity.

In a conclusion that requires some degree of mental gymnastics to comprehend, the AER argues in its latest report that there is no evidence of such predatory behaviour by the big generators in 2017 – just that they have shifted almost their entire capacity to higher cost bands.

Quite how they could have done that with more competition in the market begs a question or two, but the AER numbers are quite damning.

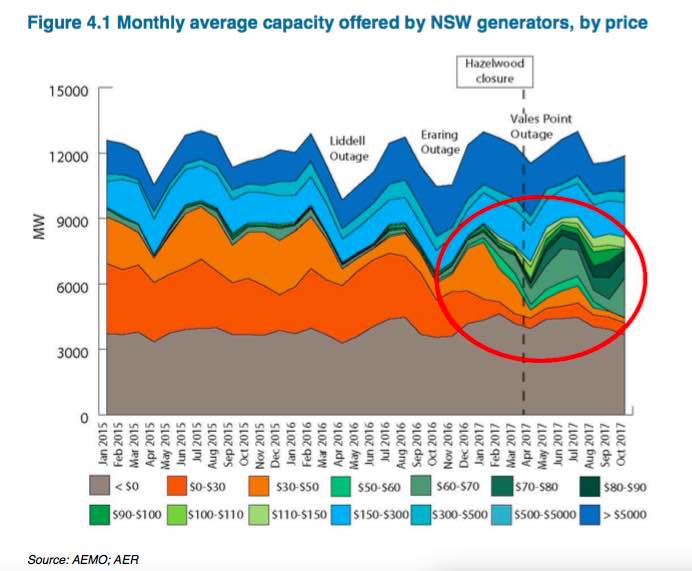

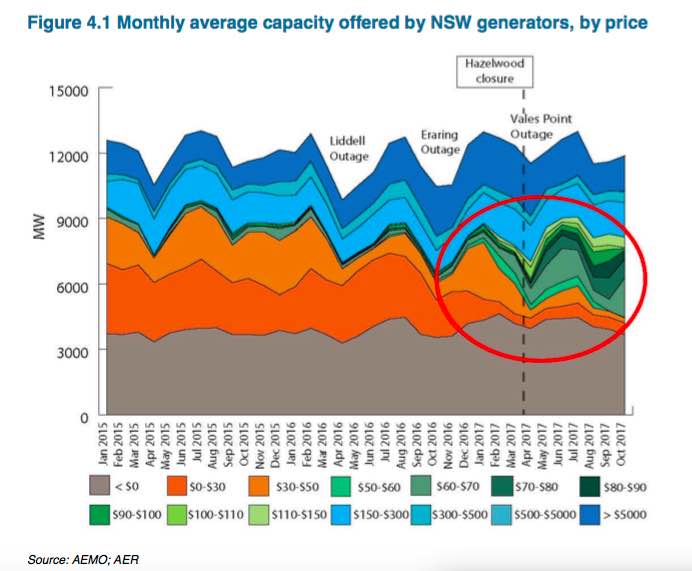

Gone are the super-peaks engineered by the likes of Origin and Snowy Hydro last November, but the AER notes that capacity that had been offered at under $50/MWh in the past year has been offered at between $50-$150/MWh in 2017.

It puts the blame for this on a rise in the cost of the coal itself, as previously subsidised supplies ran out and generators were forced to negotiate new contracts just as international price of coal rose.

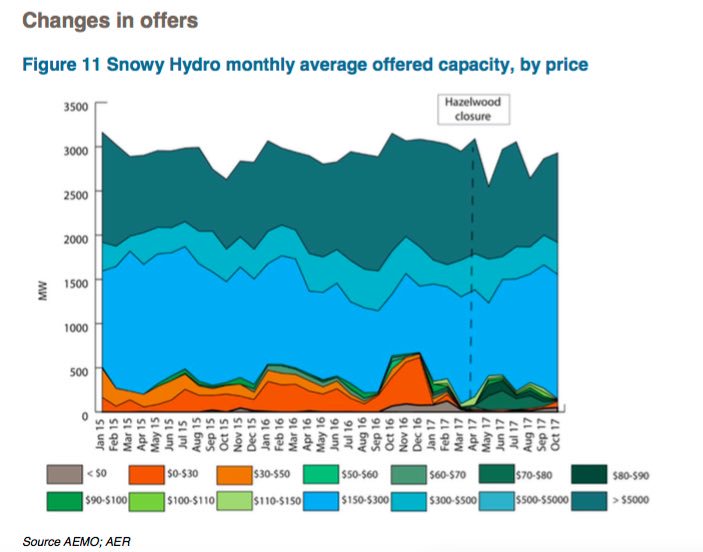

The rises were across the board – from AGL, Origin and Energy Australia. Even Snowy Hydro – generating from gas but mostly water – shifted large amounts of capacity that had previously been bid below $30/MWh to between $150/MWh and $300/MWh.

This Snowy jump is blamed by the AER not just on the rising gas prices, or even rising water costs, but by the hydro generators piggy-backing on the gas generator price hikes.

“As a result the rise in gas prices, and the lessening of the competitive constraint provided by gas, (Snowy) has also increased hydro offers,” it notes.

This graph above is interesting. It shows that since the closure of Hazelwood, Snowy has virtually eliminated any “cheap” capacity.

In effect, it won’t switch on its mostly hydro and some gas generators at a price of less than $80/MWh, but mostly you have to pay them at least $150/MWh or more just to get them out of bed.

The Hazelwood effect has had an impact across the broader market. This graph below shows the reduction of cheap capacity (orange and red) since Hazelwood closed across the whole market, coal and gas generators included.

But may God strike you down if you dare suggest that this is the result of reduced competition, or the existing players exercising their dominance of the market.

The simple conclusion, which you may whisper quietly at the altar to the fossil fuel energy gods, is that they don’t need to extract extreme prices in peak events – they are making too much money out of good old “baseload”.

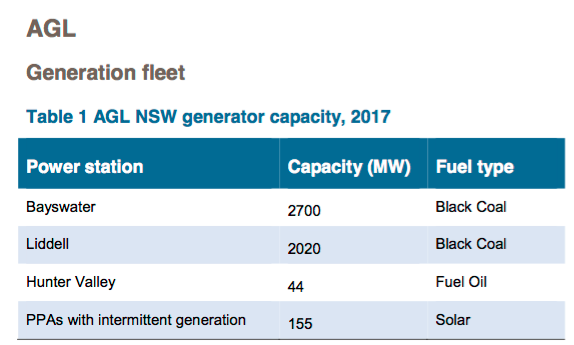

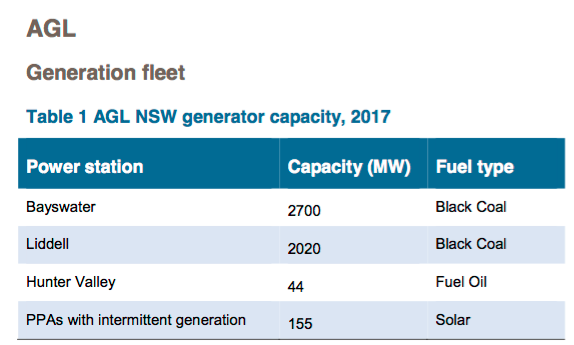

Just for good measure, the AER goes through the list of the generation fleets of all the major generators. Coal and gas plants get proper names, like Liddell and Tallawarra; wind and solar are reduced to “PPAs with intermittent generation.”

Nice. And for the record, those “intermittent” generators do have names: the 102MW Nyngan solar plant, and the 53MW Broken Hill solar plant.

On the coal issue, the AER notes that coal prices had jumped from $71/tonne in 2015/16 to $110/tonne earlier this year, forcing the “coal cost” of generation alone to jump from $30/MWh to $55/MWh.

That’s interesting. That number is barely lower than the cost of new wind farms, or solar farms, yet does not include either the capital cost of the coal plant (just the fuel cost), nor the environmental damage it causes.

Cheap coal simply doesn’t exist in NSW any more.

And if it did, the NSW generators are not offering anyone access to it – they are too busy making record profits, as the results from AGL and Origin show, and as the boost in valuation of the Vales Point plant from $1 million to $700 million also reveal.

Elsewhere, the AER alludes to the nature of competition and the market structure – things identified by just about everyone as the principal cause of the problems in the NEM, and a market power the incumbents have fought to protect – from opposing renewable targets, energy efficiency schemes and demand management, and new rules that might encourage battery storage.

The AER, however, says it needs some more time to think about this. “Analysis of these factors over a longer period is required to reach any definitive conclusions about the effectiveness of competition in the NSW wholesale market,” it writes.

It says it will get back to us in 12 months time.

Note: The changes to bidding patterns noted by the AER.

-

AGL decreased the amount of capacity offered between $0-30/MWh from November 2016. It offered this capacity at increasingly higher prices through 2017, peaking at around $90-100/MWh in August 2017. More recently, it offered this capacity at lower prices, around $50-70/MWh.

-

From December 2016 through to March 2017 the capacity that Origin previously offered between $0-30/MWh was offered between $30-50/MWh. From April 2017 much of this capacity was offered at even higher prices, peaking in October 2017 at $60-90/MWh.

-

From February 2017 EnergyAustralia reduced the capacity it offered between $30-50/MWh, offering it instead at $50-70/MWh. By August 2017 it offered this capacity between $70-90/MWh. More recently it offered this capacity at lower prices, around $50- 70/MWh.

-

In January 2017 capacity that Delta previously offered between $0-30/MWh was offered between $30-50/MWh. Delta also offered more capacity at $60-150/MWh during 2017.

-

From January 2017 capacity that Snowy Hydro previously offered from $0-30/MWh was offered at higher prices, including between $150-300/MWh.