Have one for the big stuff, but just wanted to see if I can get a better rate without him.

Hmmm… this is interesting. I believe Australia is being positioned to duplicate (but on a smaller scale) the US styled ‘Inflation Reduction Act (IRA)’.

For info; IRA is one of the largest investments in the American economy, energy security, and climate that Congress has made in the nation’s history.

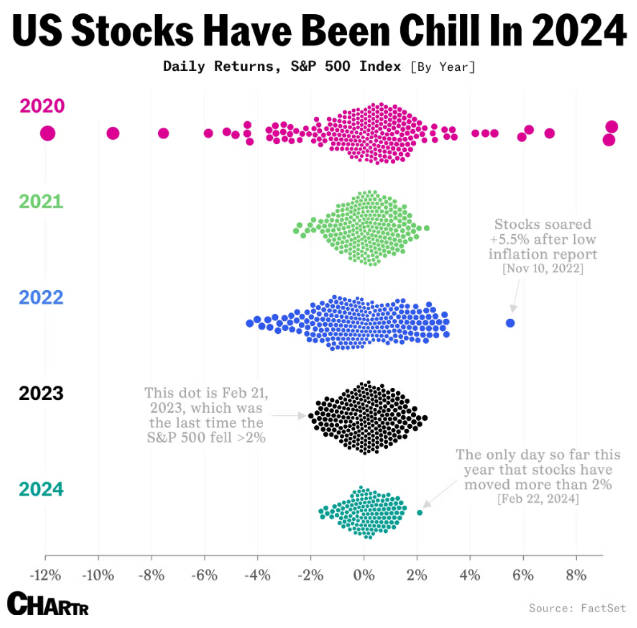

Pretty epic sell-off in share markets.

Japan down 10%.

Korea down 8%.

Currently, looks like it will continue into US session.

The asx has been on a tear for the past year. Its about time there was a little capitulation. Just wonder how long this will last?

A long time.

It looks a bit like the AUD flash-crashed down 2%…about an hour ago?..some funny stuff happening:

Maybe this is all Japan-related. The Yen is rising, and offshore investments are being repatriated with urgency…so Korean/Taiwan tech stocks are being dumped…AUD equities dumped specifically on our 4pm market-close, and that drove the AUD down?

Hmmm…this panic started in the US late Friday because a report released then has the US job market growth slowing down (but its still heading upwards).

Also, as mentioned above, Japan has a rising yen, which has caused a lot of unwinding of popular bond positions.

I assume once the dust eventually settles there will be some good buying opportunities on the ASX? A buy the dip opportunity or two. Will be worth trying to fund a few low hanging fruit buys once this correction settles down somewhat.

It’s the reverse carry trade. Lots of leverage in 0% interest Yen debt reinvested in US treasuries and risk asserts. The BOJ lifted rates to deal with domestic inflation which has unwound many of these trades. Lots of forced selling, unsure how big it will be.

Buffett pulled out 100bn?! Yikes.

The articles are saying that the US is headed to a recession - for those (me) that don’t know how this works, what are the impacts for Australia?

Cooked super funds, less people retiring.

Higher energy prices.

To name a few

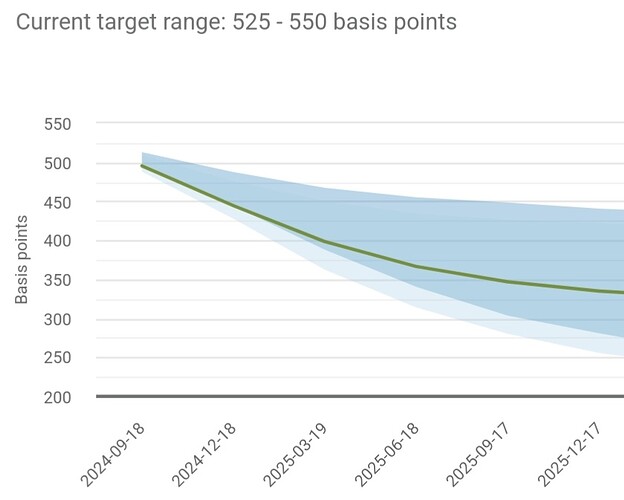

There is always volatility around rate changes. A couple of months ago there was a very mixed view on when the first US rate cut would come, then consensus moved to September and now the market is pricing a 60% chance of an emergency rate cut before then.

As others have said, the Yen carry trade unwind is very big. Use of options, particularly one day expiry has sky rocketed which also adds to volatility. The jobs data was bad and the ISM highlighted ongoing US manufacturing issues.

But… jobs data was weather related so should bounce back, US multiples are now cheapish (assuming earnings hold up)… so soft landing still the dominate narrative…

… but Iran / Israel war?

UD election mess?

AI capex before revenue

All making for more volatility and taking the focus on earnings which have been ok

My amateurish understanding…

In the US:

- Interest rates have been high for a while, like applying an economic brake. It’s not a very effective brake in the US, because lots of households have existing mortgages fixed for 30 years…but new mortgages have slowed…so the brake is working. The economy appears to be slowing down, and employment weakening.

- Therefore, it is expected that the brake will now be released, by lowering interest rates…they’re currently 5.25-5.50%…at the next meeting in September they’re expected to drop to ~5.00%…and subsequently continue downwards:

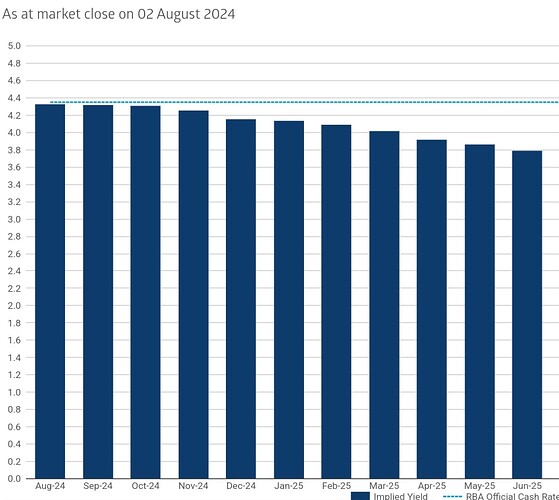

The trajectory for Australia is similar:

- Our interest rates never got as high (currently 4.35%), but they are expected to come down:

- IMO…there is a little bit of extra heat in the Australian economy due to record immigration…plus state governments spending big on infrastructure projects…plus tax cuts…plus the NDIS money firehose…etc.

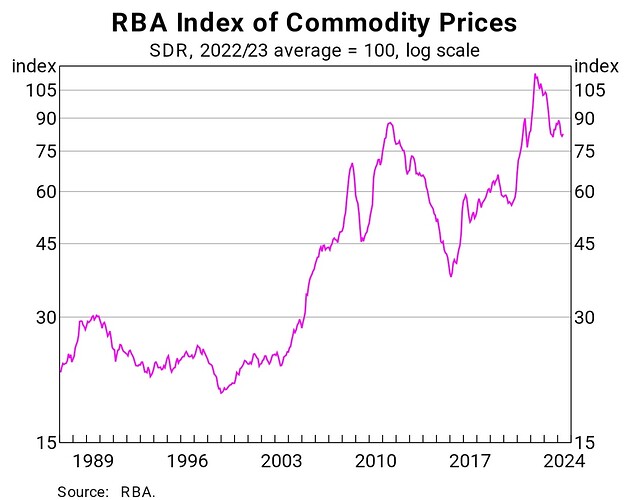

- IMO…Australia’s party music will stop if/when commodity prices decline further. It’s surprising that our most important commodity, iron ore, has held above US$100/t, considering China is amidst a major housing slowdown. Whenever that iron ore story happens, it will uniquely challenge Australia’s politicians about what they are going to do with their spending, when their income side has weakened:

Market opens flat.

BORING.

Is the potential outlook of a weaker USD good for Iron Ore prices.(driven by an expected cut in rates in the US). Coupled by Chinese government stimulus.

Seems like the fed is hawkish and doesnt want to feed a tech led hunger for debt or indebt households when employment may weaken.

That or there is an election and they are playing political games.(the pollies sure will be over there)

Strategic single sugar hit of a cut in September right before an election or a delay until after and further electorate pain.

And a rate cut is still effective there isnt it? Its not just for existing households in debt which maybe fixed. Someone is carrying that risk and wants rates lower.

Its also business, construction, debt heavy tech sector. Maybe their banking sector?