Thanks for your response Houli. I ended up buying a small parcel today anyway at 15c. I have been doing a fair bit of research the past couple of weeks and they seem to have something pretty reasonable going on. Alas, I’ve made very little from the market, so I’m just expecting to lose my money, but no panic selling from me.

My favourite ETF right now is ACDC. Best labelled share on the market. Just the name is good. Quality wise I haven’t dug deep.

*not advice, just observation.

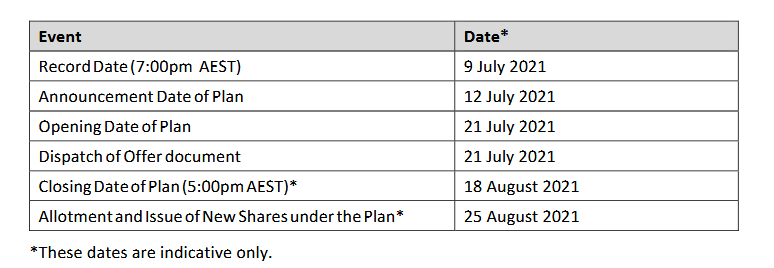

people expect prices will drop (in short term) once 5 mill extra shares get transferred in SPP as can make 100% if price still at 15c

new shares allotted on 25th august so might be a better time to buy then as would be more sellers.

but i’m like you hoping for long term growth.

Yeah I didn’t actually see that as I would’ve waited. Oh well haha.

it will be interesting how it plays out i will be following the price then.

but generally i don’t really look at it closely.

Yep, this thing us on a run.

I have participated in the SPP, but thinking I might reduce some if my current position before the 25th.

Do they notify you of your allotment before they allocate?

My Kuniko subscription of $2K has been refunded. Maybe it was way under subscribed.

Found 10K back of the couch.

What should I do with it?

Buy a bigger couch.

This seems like an appropriate question for here:

Have any Blitzers used a Financial Planner and did you find it useful?

I have an investment chat group and the topic has come up recently as someone did and found them useless and thinks a good accountant has given him better advice.

I am sure like all professions there is a gap between the good and the bad but wondering how much value you get. I would consider myself relatively financially literate and have been actively planning my finances myself for 2 years and I guess I am weighing up a 2nd opinion.

I’m going to generalise here cause it’s a how long is a string answer.

Accountants - good for specific questions.

Financial Planners - good for holistic approaches.

So if you just want ‘where do I invest’ you seem to know the answer.

If you want ‘based on x returns where will I be when I retire and what is the best strategy to get there and perhaps in a tax effective manner and ensure I have coverage if something happens to me to make sure my family doesn’t suffer’ then you’ll get more value.

Majority of financial planners are also moving to the same charging method as accountants as well now. So if you worry about trail commission you don’t need to, just find an adviser who charges.

Want the best of both worlds? Find an accountants office that has an in house financial planner.

If you do need insurance (life, trauma, tpd, income protection) you are better of with a financial planner because of access to better products. Insurance will have commissions paid to the adviser which can offset costs for any other advice you receive on top of this.

IMO the best adviser is the one you can talk to easily. Some are very technical, some want to be your best friend, others a straight shooters.

Long answer but hope it helps a bit.

As another caution as well, legally accountants cannot give you advice on what or where to invest your money. There have been firms shut down due to this.

Accountant can discuss with you tax effective options and set them up, but no investment advice. Accountants are also leant on by financial planners to setup things like trusts / smsf if required.

Financial advice is super heavily regulated. Financial planners are now audited every year. It’s not random, it’s everyone once a year.

My partner is an accountant and i’m an ex financial planner.

We don’t get invited to parties.

I nearly fell asleep reading that. You guys must make actuaries seem personable.

“You know you’re getting old when”

I recently worked out how to transfer a lump sum into super to reduce my tax, partly through conversations in this thread.

Been going to an accountant for about 10 years. That single piece of advice would have saved me $10-20k easily over that period. The guy never mentioned it.

Honestly don’t care how good he is at his narrowly defined role, that lack of advice which he surely knew at first glance would have had a huge positive impact on my financial future.

Accountants aren’t allowed to. They can tell you what the limit is and the advantages are (regarding tax) but not if you should or say that you should. That’s financial planning.

It’s a very strange line.

Yeah, but there wasn’t even the conversation. “I see you have an amount of cash available. Do you realise that transferring that amount into super before the end of the year would save you X on your tax? Can’t tell you if that is the right option, but I think you should be aware that it exists.”

First and second bit of your statement would be a breach.

Can’t say it.

If you’re wondering why it’s because he/she doesnt know your full situation of your super. You can have accounts where this has occurred and if you then put too much in then you are in breach and will pay more tax.

It makes sense for everyone except the client who doesn’t know why.

Trust me it was an absolute pain to deal with.