Very good topic. I’m 18 months from being shown the door at 60. Thankfully I am in one of the best super funds in the country, but do worry whether I will have enough to retire on. I will be using a part of my super as a lump sum to pay off the mortgage which will leave me debt free, 100k plus in the bank and an income in the mid 50k range. I have no idea if that is going to be enough but I’m not looking for a flash lifestyle. My wife will continue to work until her retirement in 6 years. Unfortunately, her super is crap as she has only been a casual worker for the last 20 odd years and her income has been at sub 20k in all that time. My plan is to supplement my income by doing reserve days adhoc (tax free income), the benefit I suppose of over a quarter century in the military, but can only do that for 5 more years. I don’t wish to be tied in to full time work as there are things I wish to do like travel and some more involved projects around the home.

Cough *whiskey

That’s what Father’s Day, Birthday and Christmas are for.

Turn 50 next year but I actually enjoy work and happy to keep going in some capacity for as long as possible. Will start winding down my hours in the next few years but I do have some fear and trepidation as I’ve worked 50+ hr weeks for 30 odd years so unsure what I’ll do with spare time. I’m fortunate that I do have a lot of super and are pretty much debt free with several rental properties worth decent money so I could quit tomorrow and live off that if need be but I’m not sure our travel budget would allow it so I’ll keep working for now

Yeah i worked in wealth management for a while. The number of client stories from wealth advisers(ie high net worth) who basically fell off a cliff when they retired.

And on not retiring…

I had a lovely older bloke who worked for me. He had a LOT more money/wealth than myself and was just getting a modest salary. I asked him why he didnt retire.(when I say high, im talking double digit 7 figures)

He looked at me point blank and said I’ve seen retirement. Half of my mates are.

As soon as your retired he said your brain turns to mush. He said it was the last thing he wanted to do. He couldnt hold he said good conversations with them anymore.

AFAIK into his 70s hes still working. Enjoys a few holidays, spending time with the grand kids and weekends in his holiday home. I hope he can keep at it.

Retirement for some people is necessary. I have been working since I was 16. My jobs have been physically and mentally demanding. I’ve not had the luxury of always working behind a desk, so therefore for me, my body and mind are looking forward to a permanent break from those demands.

I’ll end up doing ‘work’ but not at the current level.

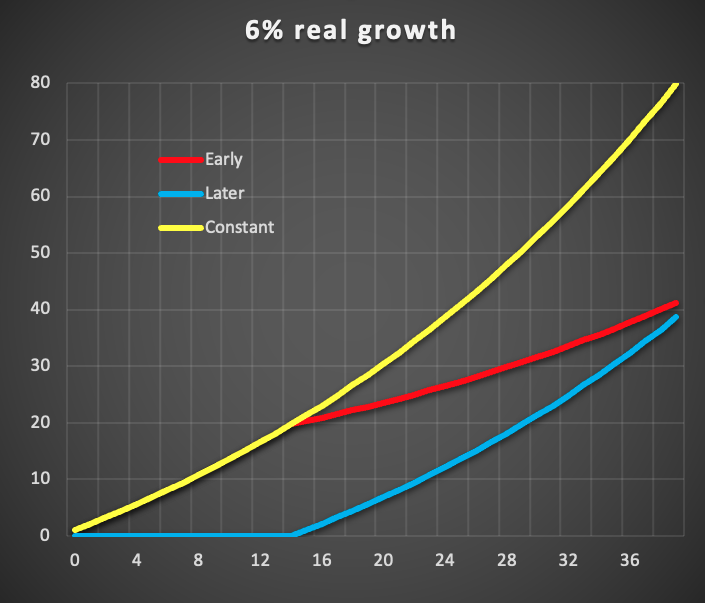

I’m happy there is comment on other than the money side of things, but to hit the point above, the graph below shows:

- investing 1 unit every year

- investing 1 unit only for the first 15 years

- investing 1 unit only for the last 25 years

Yes, you might (might) have more spare money later in life, but getting in early has a huge effect.

(I started relatively late, but maximising the salary sacrifice for enough years has caught me up pretty well.)

I plan on doing a history degree or further study for pure interest to keep the mind active.

SNAP - that is what I am thinking of doing. Potentially Museum curating (or similar).

Great idea. We are hoping to base ourselves somewhere in Latin America for a year to learn Spanish & do some hub & spoke travel. The dog may have other ideas tho.

My plan too. Plus, hoping I can teach part time. I did a couple of small teaching projects last year and loved it.

Yeah i worked in wealth management for a while. The number of client stories from wealth advisers(ie high net worth) who basically fell off a cliff when they retired.

And on not retiring…

I had a lovely older bloke who worked for me. He had a LOT more money/wealth than myself and was just getting a modest salary. I asked him why he didnt retire.(when I say high, im talking double digit 7 figures)

He looked at me point blank and said I’ve seen retirement. Half of my mates are.

As soon as your retired he said your brain turns to mush. He said it was the last thing he wanted to do. He couldnt hold he said good conversations with them anymore.

AFAIK into his 70s hes still working. Enjoys a few holidays, spending time with the grand kids and weekends in his holiday home. I hope he can keep at it.

seems a lot of people in your life dont have any hobbies or focus other than their career, how boring.

if these rich old types with legit no direction in life because retirement want to stay busy they should look into volunteering and actually giving those in need access to their experience, will be far more fulfilling than taking another 50-90k job off someone that needs it

I had my super assessed before Xmas. Now I’m 40 and a homeowner I thought it would be good to get a health check on it. The last 5 years one of my mates has been managing it for me. He’s a wealth advisor and having him there giving me specialised advice is better than the cookie cutter super plans out there. The assessment was independent of my mate, and even then they said whatever he’s doing for me is working and they couldn’t recommend anything to change. From that perspective it’s reassuring. I see myself working to around 65 so we shall see how we go. I’m on track for a comfortable retirement but by no means living a lavish lifestyle, but that’s all I want anyway…

I’m 57 and was planning to retire at 62 but I’m seeing too many people around my age either die or come down with illness or reduced mobility. It has scared the hell out of me. I have done the figures and I now plan to work until 60 and then move to part time / casual work and get some travelling in. I know it’s not great planning but there will be funds available through 2 inheritances which could be up to 15 years away but I easily have enough super and investments to get me through. My wife keeps sending me links to camper vans and places to visit in Australia, so at least I have her vote for an early retirement. PS Good topic, looks like you hit the right audience.

I haven’t officially retired but I was made redundant from my last job at the end of June 2022 (just before my 62nd birthday).

After 44 years in the workforce, I decided that I wasn’t that interested in working anymore…I enjoyed the people I worked with, liked the work that I did…but no longer liked the industry I worked in and particularly the employers in that industry.

So I just didn’t look for another job and so settled into my current lifestyle.

I had worked out that the money I had saved would get me through to official retirement age and so I wouldn’t have to access my super until then (based on no financial disasters between now and then).

I own my house and have no other debt apart from regular bills and monthly credit card expense.

18 months in and I have not spent as much money as I had budgeted for so am doing ok ![]()

I spent three months on a road trip last year, have a trip to Egypt & Jordan booked in a few months time and will hopefully be able to continue to have the occasional O/S trip into the future.

Adjusting to not working was easy for me as I had managed to have several long breaks throughout my working life and also had my father as an example of what not to do on retirement (he had no plan at all and it took him almost a year to establish some sort of routine).

I think that last bit is the key…you need some sort of plan in terms of what you want to do and how you want to live your life going forward…it doesn’t need to include having heaps of money (that would be nice ![]() ) but enough to finance the type of lifestyle you want to have.

) but enough to finance the type of lifestyle you want to have.

Thats a bit of a valued judgement on someone you dont know.

The bloke in question spent plenty of leisure time.

And with an unemployment rate south of 4% its hardly a problem of taking up a job for someone else.

Its certainly not living to work rather working to live.

After just spending around 6 weeks off work im looking forward to getting back to it.

Personally i think anyone whose miserable working and dreams of not doing so might be best to reevaluate what or how they approach work and life.

The world over ive met very happy and content busy working people(and ive met miserable working people too)

Miserable people tend to find a way to be miserable retired as well.

you’re the one that said wealthier than you, and stipulated 7 figures. you provided all the value judgement needed

Tied up in property yeah.

Would be akin to say Dodoro or Welsh(is he on the board) not working at Essendon.

Working doesn’t have to be miserable.

then volunteer and be a social benefit