There’s no place like home.

Left foot, meet the other left foot… Two left feet.

DisPutin saved by NKR. Far-Kim.

Kim Jong-un sends Vladimir Putin 15,000 ‘slaves’ to boost Russia’s ailing workforce

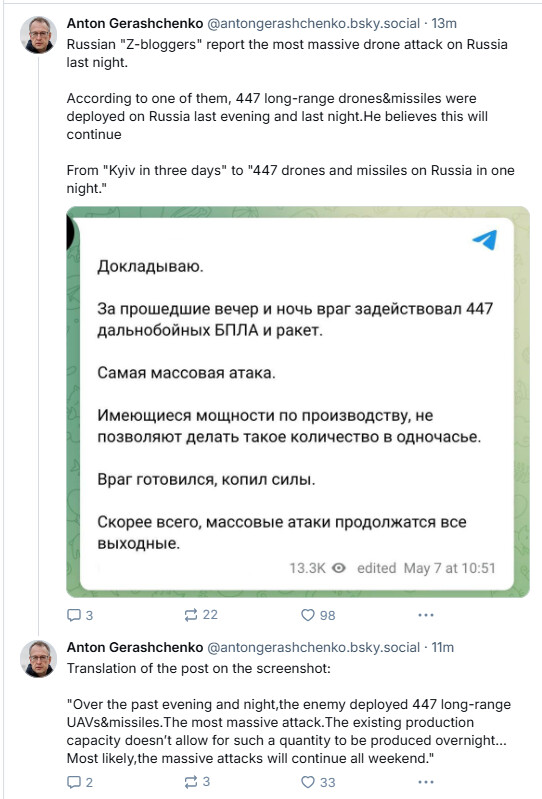

What if you threw a Victory Day Parade and no-one could get to it?

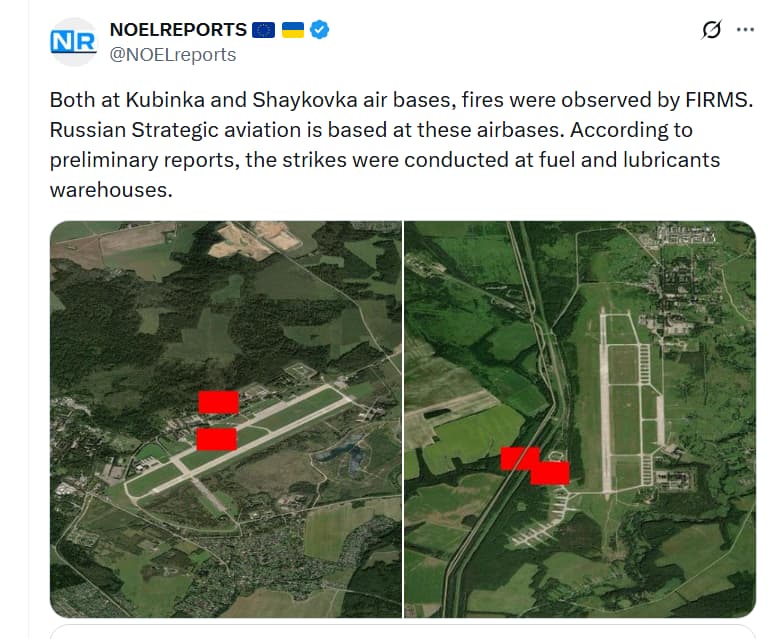

Ukraine’s Drone Offensive Disrupts Major Russian Airports Ahead of Victory Day Celebrations

Kyiv is complimentary of DisPutin’s Big Bash.

Pokrovsk - again - still.

EU, drone home.

You’re on the clock.

Lithuanian Defense Minister: Europe May Have Only 2–3 Years to Prepare for War with Russia

G’morning all.

It boils down to one word… Putin.

One word again.

The equivalent of Aboriginals with Australia Day Celebrations.

I’d lob a HIMARS right on the Royal Box if I was Zelensky.

Ukrainian officials have dismissed the likelihood of an attack on Moscow before May 9, citing air defense systems and potential U.S. backlash

That’s what we like - quick, decisive decisions… Only three years. Wow.

Russia planning even greater espionage.

Russia’s Foreign Intelligence Service has been instructed to increase the number of influence agents in Ukraine’s neighboring countries, particularly targeting Moldova’s political processes

Rats … sinking ships …

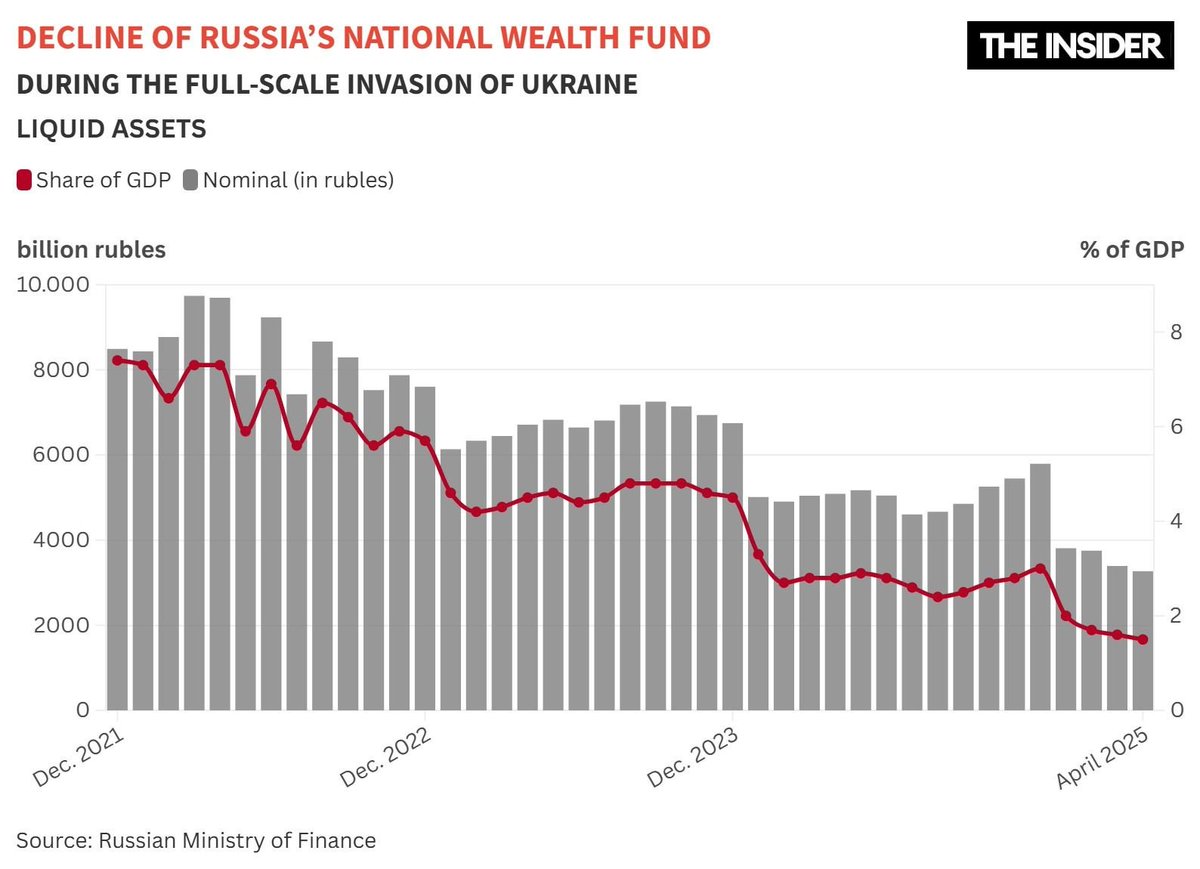

How bad is Russia’s war chest? Has the country entered stagflation? Why does it fear falling oil prices, but not a crash? And how is the tariff war hurting Russia?

These questions — and more — are explored in a special interview with Russian economist Vladimir Milov.

2/ Tariff wars:

China’s economic slowdown has closed its market to many Russian products, hitting major industries hard. The China-focused Russian coal industry is struggling, and Russian non-energy and non-commodity exports are down by about a quarter compared to pre-2022 levels

3/ Tariff war will obviously exacerbate the Chinese slowdown. The slower Chinese growth, the less market for Russian goods. Share of China in the total Russian exports is as high as a third now - we’re heavily dependent on this market and its well-being.

4/Oil prices:

The biggest loser from the falling oil prices is not Russia, and not OPEC - it’s the U.S. shale oil industry. Oil production costs in the U.S. are higher. This means that, if global oil prices fall below $50, part of the U.S. oil production will be wiped off

5/ Russian oil companies can manage under $30-40, but the state budget will suffer. Putin and his allies believe they can endure low prices, anticipating a recovery. If oil stays at or below $50, it would likely be short-lived, which would please Putin.

6/ In these circumstances, I’d say the best scenario is if the international oil prices stay somewhere around $60. Given the sanctions-driven discounts, that means Russian oil is cheaper than $50. These are the prices that will significantly hurt Russia

7/ Employment:

Russia continues to face high hidden unemployment, with many workers nominally employed but on unpaid leave or downtime. Rosstat estimated hidden unemployment at 4.7 million in Q4 2024, or over 6% of the workforce. This brings the total to about 9%

8/ National Wealth Fund (NWF)

As of April 1st, the liquidity portion of NWF was $39 billion, lower than the 2024 federal budget deficit of RUR 3.5 trillion. The 2025 deficit is expected to be higher, with rising costs and declining revenues due to falling oil prices and slowdown

9/ Already now, non-oil revenue in Q1 2025 grew only by 11% year-on-year, against 26% growth in 2024, and 18% planned growth for 2025. Of which VAT, by just 9%, as opposed to 22% in 2024 and 17% planned for 2025. A slowing economy generates fewer taxes

10/ Inflation:

Nothing is working except monetary emission — printing money. The government can’t borrow, as it’s cut off from international markets. Domestically, with OFZ bond yields above 16%, Russia spends more on debt servicing than it raises from the domestic market.

11/ Authorities appear to tolerate inflation, with some State Duma members during the April 9th debate saying - “We’re not Turkey or Argentina, so what difference does it make if inflation is 12-13% instead of 10%? Let’s print a couple of trillion rubles; no one will notice.”

12/ No question that filling the budgetary gap with printed money will lead to even higher inflation, which will destroy any prospect for economic recovery. So, basically, the Western sanctions are working - albeit not as fast as we hoped, but still.

13/ Lifting sanctions:

The U.S. alone won’t be able to reverse sanctions. Before the 2022 invasion, Europe was Russia’s key investor and trade partner: over 67% of the accumulated FDI stock came from Europe, and around 50% of Russian exports went there. For the US, 1% and 4%

14/ Russia could benefit from U.S. sanctions being lifted, which may help sustain Putin’s struggling economy for a while. This includes access to U.S. technology and the lack of a comparable and effective global sanctions enforcement mechanism in European countries

15/ Thank you for reading. This is a brief summary with key points from the full interview, available via the link below. Please consider liking and sharing this thread to help increase visibility

This sounds like a significant shift in the political landscape of the region, but which way is the shift moving?

Russian losses per 07/05/25 reported by the Ukrainian General Staff

+1270 men

+14 tanks

+3 AFVs

+71 artillery

+124 UAVs

+1 cruise missile

Bump!