The size of the HECS debt isn’t what determines repayment rates.

Mandatory HECS / HELP repayments reduces your disposable income and therefore reducing your borrowing power.

Towards the end of the Menzies reign and continued by his successors, Commonwealth scholarships and free places, with means tested financial assistance, increased significantly.

There were also bursaries at State level for teachers undertaking degrees.

There was the problem of the numbers of those in State schools going on to matriculation, necessary for tertiary education.

Much earlier there was a fee to formally matriculate , not enough to pass the exams. And in the Victorian Upper House, voting rights were limited to land owners or matriculants. Some couldn’t afford the matriculation fee.

I’m sure there used to be a 5% or 10% discount but it was elimated as it only benefited those who could afford to or had wealthy parents.

25% discount for pre-payment as I recall (which as you say only benefited those with wealthy parents).

15% discount for voluntary repayments, which I took advantage of using a small amount of money received though inheritance. The main reason for doing this was that I got a 6% increase in disposable income by clearing the HECS repayments.

I think the much bigger issue has been the huge increase in student contribution for a degree over the last 20 years. Reduce that by 20%.

Agree that the 25% discount for prepayment mainly benefitted the wealthy.

My parents paid approx $1500 as a pre payment. almost covered course load for semester 1 back in those days.

And then after I finished I paid off HECS early was 10% discount at the time.

I’m sure there are lots of people now on good salaries, that would consdier paying some early if there was a small discount.

I mean plenty still pay early in the final year to avoid the June indexing.

So those who can afford it get a leg up.

Those who can’t well, too bad.

Perfect policy for current costs of living.

Yep, I took advantage of that too. Paid the debt off early with the income from my first real job. Which, of course, I was only able to do because my family was in a financial position that meant I was able to live at home.

But also, my outstanding hecs debt at the time was only about $10 grand. My course back then cost $2500 per year, and I did 5 years. Even adjusted for inflation, the same course now would cost fully six times that much.

i think the acceptance criteria is more to do with capacity (limited places) than it is about the standard of intake

Yep, my fees were about $3000/year. There was a substantial increase the fees for students commencing the next year (up to $5800/year), but the inflation adjusted amount now of my cost is a bit over $6000/year which is 20% less than the current fees for a similar course (Band 2, about $7,500/year) which is not great but not as big an increase as I thought.

Was there a lowering of the threshold for compulsory repayment somewhere along the way? (I have a vague recollection there was.) That would make it hard making ends meet if the repayments kick in at a relatively lower income.

Kick in at around $52k and repayment is based on a percentage of your income, from 1% at the lowest bracket to 10% if you earn over $150k.

Also gets funky if you have fringe benefits or you salary sacrifice extra into super.

I’m 99% sure the libs messed with the repayment threshold, I don’t remember whether it was Abbott, Turnbull or Morrison though.

I’m also not sure whether the threshold is indexed, and if so, to what. If it’s indexed to CPI then that’s another little knife in the kidneys, because wages have grown a big chunk slower than prices in recent years.

We haven’t adapted to Essendon being crao for 20 years. Especially the lid-offers.

FTFY

Welcome to Tory world.

In Vietnam due to hydro power, prices are only 7c per KW.

Think in Tas were closer to 30c per KW

| Peak | 36.198 ¢/kWh |

|---|---|

| Off-Peak | 16.855 ¢/kWh |

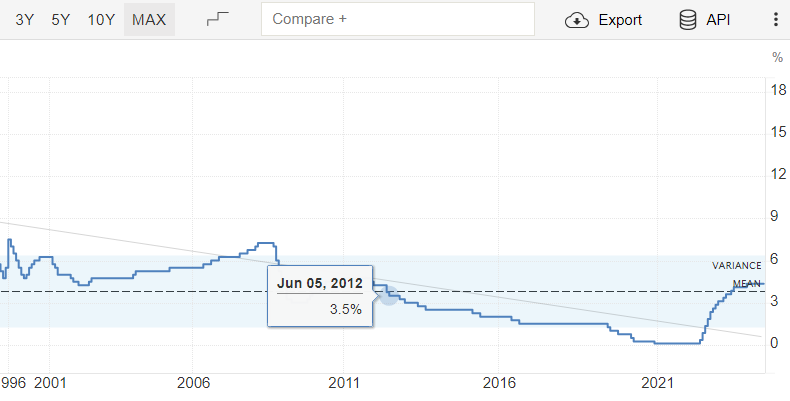

RBA has flagged potential rate rise/rises might be necessary to get inflation under control. RBA staying vigilant on petrol prices and the upcoming budget. Economists now saying any rate cut may not be until June 25

I’ve heard that many different thoughts and opinions and don’t know who to believe anymore. FWIW my bank manager is saying 3 more hikes before it starts coming down again. I should have a wager with him ![]()