Don’t worry about it.

No government would ever do it.

It’s galling to hear the suggestion from the guy who insists you pay for his accountants, but that’s about the only part that makes it worthy of discussion.

Don’t worry about it.

No government would ever do it.

It’s galling to hear the suggestion from the guy who insists you pay for his accountants, but that’s about the only part that makes it worthy of discussion.

uh oh, mummy and daddy labor are fighting again…

They have this new type of poll. Its called an actual election. But its not foolproof.

I just spat my franking credits all over my keyboard.

Returning to core values ( blue collar workers) may not be the way to go for labor.

Manufacturing industry is almost defunct, many building industry workers who might have been “blue collar” in the past have abns, sm super funds and like negative gearing. They have deserted labor in droves in this election.

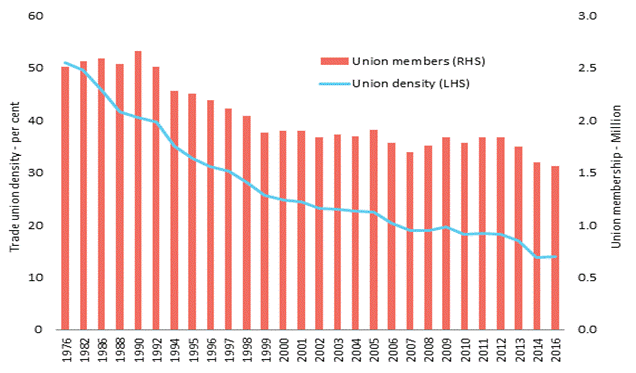

The Australian economy has changed massively since Gough ( about 50% of full time workforce trade union members). Bob, Paul and Button actually were instrumental in the inevitable transformation to a service economy that is now almost complete ( Now union membership is less than 15% of the full time workforce)

The whole basis of the labor movement and ALP must move ahead, not go backwards to its core values if it is going to stay relevant.

Blue collar worker vs the white collar boss is outdated by 30 years.

I think the biggest fantasy viewpoint throughout this whole campaign was that the “average” Australian at or near retirement age has investment properties and a share portfolio.

You would have to be living in a pretty fkn impenetrable bubble to believe this.

Yeh, but ‘aspiration’…

Just gotta work harder I suppose

Really? Some of the leading Labor people still think its relevant

by Gavin Fernando

20th May 2019 10:07 AM

As Labor prepares to replace Bill Shorten in the wake of the party’s shock election loss, an unlikely contender is considering entering the race.

Hunter representative Joel Fitzgibbon, who hung onto his seat despite a 10 per cent swing, said he was not prepared to rule out running for the leadership if Labor didn’t match his concerns about representing the regions and its working class base.

"The Labor must reconnect with its blue-collar base… "

IMO they are wrong.

Doesn’t matter its gunna be Albo, not Joel.

And if you believe the Libs will actually implement their delayed compulsory superannuation percentage increases, I have some prestige bridges to sell ya.

(It’s set to go up by 0.5% for five years straight, starting in 2021. Labor had originally intended it to reach 12% in this coming financial year, but the Libs pushed it back six years and probably will kick it down the road again.)

If it’s simply about getting elected on “traditional” party values, Labor need to restructure the tax system for their own political advantage.

If you’re going after the rich, and multinationals, then go after the really rich. Their crackdown on multi’s wasn’t actually going to raise that much. They were looking for far far more from small business Australia.

Find a fix for the literal millionaires paying zero personal tax.

Introduce a new tax bracket of , say, 60% at 300k.

Slot another one in between the current ones at 90 and 180. Shuffle those two if need be. It then gives you three tax brackets to claim to “crack down on the wealthy” without impacting those earning around 100-120k - which a lot of traditional Labor trades now are. They seem oblivious to how well some of their Unions have done in lifting construction and mining wages - all this rhetoric about wealthy and top end of town actually applied to a lot of (now former?) Labor voters. Splitting the tax base further will be expedient for them politically. No one is going to decry making executives on 500k pay more tax. But plenty seem ■■■■■■ off that 1.5 times the average wage is declared ‘wealthy’ and they’ve seemed to have thought this for a while. Even in the last election, iirc, they were looking at novated lease arrangements for people on 90k? Madness politically.

Mind you, a system reliant so heavily on income tax from a small population in an enormous, infrastructure heavy continent is probably flawed anyway. Even with the GST, the options are always apparently involving getting more tax from individuals. So we’d need a bigger and faster growing population? And we’re increasingly a services only economy with shrinking manufacturing base so daily discretionary spending money is even more important to generating turnover. But that’s probably for an economist argument as much as a political one.

Farking Telstra calling & threatening to cut off my cable internet if I don’t downgrade to the crappy NBN.

Thanks to the Libs for stuffing this up.

Thanks to the voting ignorati for endorsing their ineptitude.

Labor should bring in John Setka.

Labor would have done better with the policy

Where not them.

But sometimes its better with the devil you know thats why scott Morrison stayed in. a change to Shorten would have brought about uncertainty.

I would go a different direction:

Australia has the most generous dividend imputation system in the OECD. It’s a laughably regressive tax policy. ALP were right in trying to bin the excess franking credit tax refunds.

I actually feel that anyone opposed to the franking credit system can’t possibly understand how it works.