Thanks all, appreciate the different perspectives.

We patched our places a few times but the underlying issue meant that the cracking in plaster came back until we did the stabilisation treatment.

We had the house replastered and painted last year and it looks great. Older house really need top quality tradespeople who know what they are doing. Lots of cowboys out there.

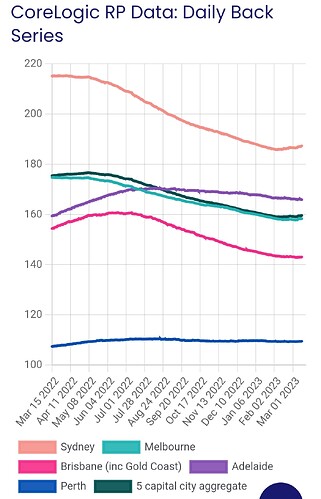

Australian dwelling values have dropped -7.9% over the last 12 months - which is the largest annual decrease ever recorded, says CoreLogic.

Monthly sales volumes averaged 37,020 over the past six months, down from an average of 40,155 over the past five years.”

• Sydney dwelling values are -13.5% below the record high of Jan 2022.

• Melbourne values are -9.6% below the record high of Feb 2022.

• Perth values are only -0.9% beneath the record high of July 2022.

Still 30% up on the previous year

I’d been looking at a place in Moonee Ponds, apartment, 2 bed 2 bath. Very nice, not in my ideal location (a bit far away from the train station but off Pascoe Vale Rd so the tram was easy access). Decided against it as it has a car stacker. Anyway a month after I said no the Real Estate agent gets in touch and the asking price of that apartment has dropped by $65K. Clearly finding it hard to shift some places. You might get a bargain if you do your research…

has anyone got any anecdotal feedback on bank valuations on refinancing?

im thinking of taking a look to save a few bps on a rate, but won’t short term at the expense of equity.

I figure the Vals are heading south, I wonder by how much…

I remember when I had 2 properties, for a period of time, was going to rent one and keep other, got a bank valuation. Ended up selling the other property,

And Bank valuation came in approx 10-15% lower than the actual selling price (1 month later), So i would hazard a guess to say they will be a little conservative.

Recently refinanced and the valuation form 3 different lenders came back above expectation. This is in a 91 build, 4 bed 2 bath in the outer north western suburbs.

I suspect the next six months are the cheapest you’ll find properties for a long time.

Rates are apparently levelling out.

Some people won’t make it (and I Farking hate that), and we’re due for a massive immigration spike.

That will affect both renters and buyers.

I really don’t think anyone knows where interest rates are going because they are a direct proxy for inflation. They will keep going north if inflation persists even if it means defaults on credit obligations and unemployment.

No evil trumps inflation in an economy.

I think the trifecta of

- Ukraine War - direct input on energy and food production and it pushing through the supply chain.

- China - its heavy handed reaction to covid and now it’s opening up again. Whether it’s a net deflator or inflator is yet to be seen. ie domestic demand on goods or increased production.

- Monetary Policy - in retrospect the central banks got it wrong keeping rates as low as they did for as long as they did, especially when the economy had no capacity to grow(ie during covid).

All of these very significant factors put serious ongoing upward pressure on inflation.

Not to mention both the chip crisis in Taiwan and finally probably the worst of all “inflationary expectations”. Thats driving the rise in company profits, probably people willing to dip into their savings or go into expensive debt for their lifestyle etc. ie accepting a new dangerous normal.

If everyone expects there to be inflation, we will get it. Which means we will get higher rates.

Put it this way, I can’t imagine our central bank cutting interest rates whilst inflation is above 3%.

Would hate to be a pensioner or unemployed right now on fixed income.

IMHO the Government of the day needs to start finding more ways to cut spending and raise revenue fast to head off the blunt hammer of the central bank.

Property prices in Sydney and Melbourne have started going up (massive migration influx?):

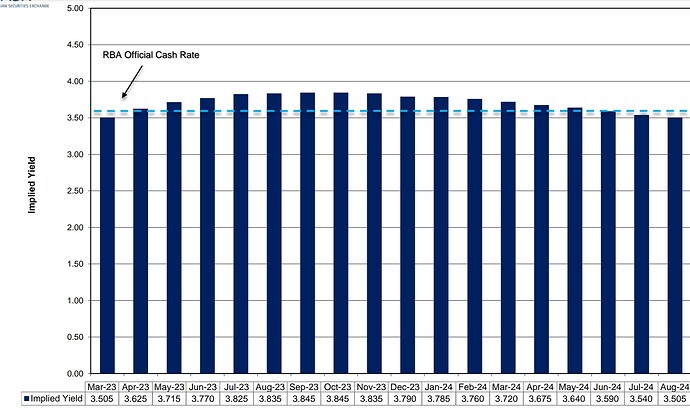

Right now, after the SVB collapse, rates expectations have dropped dramatically…one more rate rise only priced into the market:

Prediction I heard was 1 more rate rise, then appox 8 months (Given history average after last rise) before they start reversing.

My bank manager seems to think 3 more rises this year and then start going back down next year

Did you ask him for his rationale?

Or is he just trying to sell you a loan?

The economy is not like recent history.

There would have to be some reversal(and there can be but it would probably be messy) for the reserve bank to start an easing cycle.

Possible but I wouldn’t be literally betting the house it will.

He said that is just the chatter around his bank and with other big banks. He is one who believes it’s a flawed system and that the RBA has gone about it wrong as it’s really only penalising a small percentage of Australians and those folk are doing the heavy lifting. He is of the same belief as me that spending is still going crazy and these hikes have done little to the majority

I only paid off my last big loan recently so no I’m not looking to get in debt again ![]()

The numbers out of retail banks would be a rise in bad debts and defaults.

But….

Unless its going to bring down one of the banks, I cant see monetary policy going into reverse.

The numbers on a page would have to mean our retail banks start to lose money instead of make record profits on improving margins.

He is of the same belief as me that spending is still going crazy and these hikes have done little to the majority

Spending up cos basic needs are up. Only way to stop it is to make necessities cheaper through govt policy. But lib lite are cowards

feeling pretty thankful that we (partner and I) made solid decisions in the last year - investment loan fixed at 2.09% will last another year and a half and hopefully by then most of these rate raises will have passed and come down even - PPOR loan also fixed on a fairly nice rate for another 2 and a bit years I think - always good to have a family member or friend in and around the industry to provide reasonable advice !

imagine being american and locking in your interest a 2% for 30 years.