You owe me a beer.

I’m not a stock guy and was tempted by the post, then thought better of it. Just checked the price, should’ve snuck some coin that way ![]()

Gold, silver gone bananas.

Rear earths doing the same. Nice day.

You wanna make a bid for my rear earth collection?

Past purchase dates are no guarantee of future results.

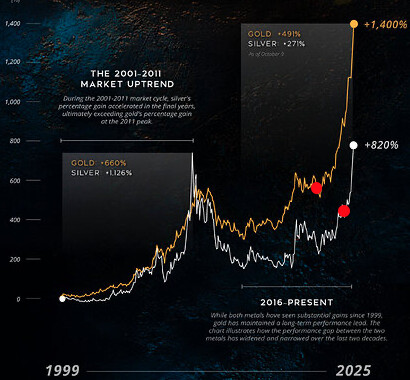

Sharesight says my annualised returns have been 40% (gold) and 55% (silver).

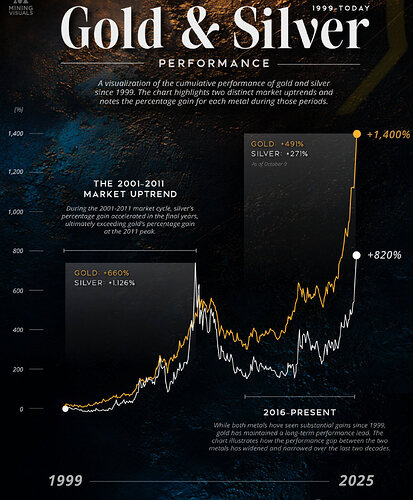

US-focused, but nice graphic. If you think you can reliably pick the next-decade-winner, you’re probably wrong.

I’m not convinced that such a large exposure to US bonds would result in optimum results over such a long period of time.

It looks like non US equities are due for a good run which is where alot of commentators are recommending.

Moreso bonds gave the least worst results resulting from WW2, Inflationpalooza (concealed partially by the floating of the gold price), and the “lost decade” (that Australia dodged).

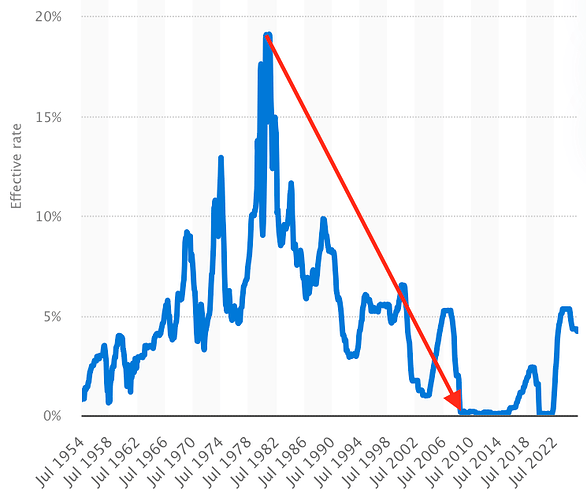

And holding bonds while the interest rate went down for decades was free money. Hard to replicate that, though the USA is trying to make debt cool again.

I guess they’re not critical minerals.

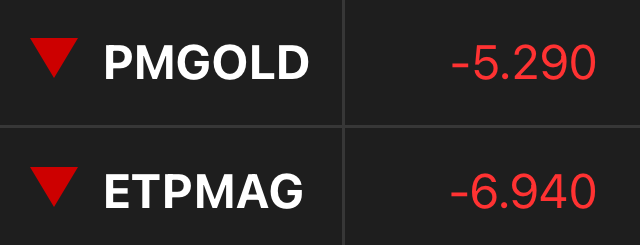

(Second is silver. Shows percent down in AUD. Both buoyed very slightly by currency change.)

Yesterday Gold was apparently certain to go to 4,800 and then onwards to 8,000. Then the biggest fall for a day since 2013(?). Double top on technicals can be concerning for short term. Next support zone I think is around 4,020. Interesting times. Expect the unexpected.

It could go either way from here.

The old adage, that if an investment strategy/asset class makes the news it’s time to sell.

One of the big winners from the US-Australia $US8.5bn ($13bn) critical minerals pact says China’s days of holding the world and strategically vital manufacturing industries to ransom are coming to an end.

Arafura Rare Earths boss Darryl Cuzzubbo said the deal was “absolutely” the biggest step toward breaking China’s stranglehold, and elevates Australia as a Western world leader aligned with the US, South Korea and Japan.

The Gina Rinehart-backed Arafura is set to receive up to $US300m from the Export-Import Bank of the US to advance its Nolans project near Alice Springs. On top of this, the Australian government is boosting its support for the Nolans project by $US100m to almost $1.2bn via an increased share of the equity.

It’s so nice to see the big mining conglomerates continuing to get funding.

Not!

Do you have any other ideas on how to extremely rapidly expand rare earth mining and processing?

My best idea is to go back 20 years with a Time Machine and don’t get stuck in such an obvious trap, but unfortunately my delorian has a flux capacitor problem.

Felix Gold will be producing antinomy in size, probably 5000 tonnes pa from Q1 next year.

Have a look at their recent announcements and presentation on their website. While everyone will be spending years on feasibility studies and $100m+ on capex… these guys will be just using tip trucks and front end loaders to pick it off the surface.

So production can happen very quickly. This one just gets lost because of the “gold” in the name and that it is an Australian company with land in Alaska.

They could have 5000 tonnes X $40K a tonne revenue next year… with limited costs…

Yes and no. Sometimes an investment idea makes the news more than the investments performance.

It’s picking up on the former rather than focussing on the latter that’s important. (Although sometimes I like bad news on things I want to invest in long term- gets them into value territory to buy)

The Australian component should be provided as a loan and to be paid back from production profits once producing and making money above a certain threshold.

No profits, no payback.

I think the investment structured as it is is primarily due to a) urgency that overrides normal procurement processes and b) needing to appease Trump, so a small investment in rare earths secures higher value favourable treatment in other areas.

Benny, you spend way too much time playing in your backyard with your HIMARS rather than fixing your flux.