It’s to be in a TV commercial…so I don’t think they’d sue me unless the don’t sell anything…

Cash money all the way

You’ll need an abn but no point registering to collect gst if it’s a once only thing. From memory, 70k turnover is the upper limit.

You might need public liability insurance depending on the work and the clients needs.

You might also need a TFN as a sole trader, I can’t recall if you can just use your personal one.

You’ll need to submit an official invoice , assuming the client wants it all on official record at their end. But if they don’t, then cash is far far preferable.

GST registration is compulsory where gross income is $75,000+ (apart from taxi, ride share activities where it is required from $1).

A person or entity can only have one TFN. It doesn’t matter if they are an employee, ABN business or derive passive income such as investment income. All fall under the particular TFN umbrella.

Are they getting you to be the “Before” or “After” person?

But seriously, if you get an ABN sole trader number (easy to do online) you will be set. As Saladin says, you won’t have to pay GST on the amount you are talking about.

I have a TFN and also [was forced by my former employer to acquire] an ABN Sole Trader number. It all has to get reported on your tax, as I think PreliminaryPoint described.

Everyone has a TFN.

Whereas, broadly speaking, an ABN is required when carrying out business activities.

One cannot get an ABN without having a TFN.

If you supply services to someone and don’t quote an ABN, if they are a business, they may be forced to withhold 47% from the payment (which you get back as a credit anyway when you lodge your tax return).

They probably would rather you quote an ABN rather than withholding 47%, paying it to the ATO and sending you a payment summary.

Technically you probably don’t even need an ABN though for them to avoid their withholding obligation.

The withholding only applies if you supply your services in the course of an enterprise carried on:

Payment for a supply

12 - 190 Recipient does not quote ABN

(1) An entity (the payer ) must withhold an amount from a payment it makes to another entity if:

(a) the payment is for a * supply that the other entity has made, or proposes to make, to the payer in the course or furtherance of an * enterprise * carried on in Australia by the other entity;

An enterprise is a far lower threshold than a business. But it sounds like performing in a one-off commercial wouldn’t even be an enterprise, let alone a business. From the ATO’s ruling on enterprises:

Activities done on a small scale that do not amount to an enterprise

186. There are a range of activities that are of such a small scale that they do not amount to an enterprise. As explained in paragraph 180 of this Ruling, where activities are conducted on a small scale other indicators become more important in deciding whether they amount to an enterprise. While it is always a question of fact and degree in each particular case, it would be difficult to conclude that activities are an enterprise where they are of a very small size and scale, are carried on in an ad hoc manner, and there is little repetition or regularity.

You might go back and say there’s no need to quote an ABN as you’re not carrying on an enterprise but they may insist as they wouldn’t want to be on the hook for failing to withhold if you’re wrong about your professed status as a non-enterprise.

Palantirs play is that it’s just the US taxpayer sending it huge sums of money.(or the US government)

yes it’s got lots of other business but that’s why it’s gone nuts

The funny thing about NVDA which is my largest stock position, is it’s cheaper now that it was before the chat GPT moment. Everyone is waiting for the hyperscalers to reduce capex and at some point they will. But NVDA’s price is absolutely justified on a fundamentals basis. Tesla, Meta, Alphabete and Amazon report before NVDA each quarter so you get a read into demand before NVDA gives guidance.

have you heard that some the names of Peter Thiel companies relate to the lord of rings series.

Planatir

Mithril Capital

Lembas

Rivendell

Valar Ventures

I imagine the value of Daniel Andrew’s two companies will soar soon. Apparently no website for them. Deals on the way.

At least @bigallan dodged having to listen to her neighbour newly going on about the price of silver!

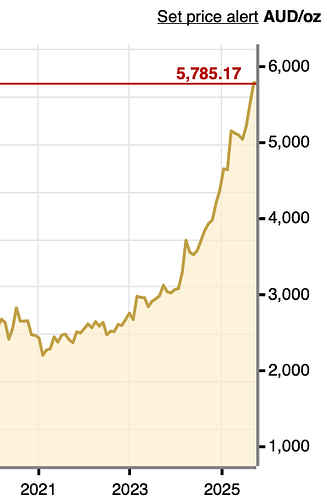

(I’m not the neighbour, but I did add a small slice of silver back in April/May. Along with solely buying at the low point for gold in Feb 2021, I am feeling a bit smug right now about my dumb luck.)

(If you’re wondering… the gold has done marginally better than Bitcoin across those 4.5 years. The five-fold increase of Bitcoin came precisely in the six months before that comparison period started…)

I don’t own any silver per se, but bought a silver asx stock last year and it has doubled.

Best purchase this year was a company i got in just after Promedicus invested in it then it went 5x

The first post in this thread, 12 years ago:

Well, we know @wimmera1 has some property. I hope he didn’t miss the +406% of the (taken as proxy for the above) S&P500 since Oct 2013…

Not every all-time-high is a sign of doom…

Hey Westy - hope you took up a position in this Sn mine down in Tassie. Green 32% in 6 weeks.

Unfortunately I did not, but sounds like I should have! Well done and thank you for the heads-up regardless ![]()

Luckily I have been holding some EOS for about a year and managed to sell half of them this week for a pretty tidy profit. A good win always makes you regret not going all in to begin with. I could have retired now ![]()

You’re welcome.

Sounds like you cashed some in before they copped a haircut today. Good timing.

I bought RAC at $1.18 due to your post on 19 August.