Went up and down in line with our market today. The dollar is minimising it a little (unhedged).

NST down 70c~ so far. Yikes. Will be watching with great interest.

If you’re a high growth investor the sell off has been brutal, close to 40% draw down since November 11th for my portfolio. However, the last few years have been exceptional. You got to take your licks when it’s your turn. I tend to do more research and make sure i’m holding the highest quality and just disconnect.

…and it may not be over yet…

The Fed “has projected several rate hikes over the course of the year,”

Indeed. Many I talk to are growth investors who historically have done quite well and the damage has been severe for them over a short period. I’m purely focussed on resources so I’ve actually done pretty well all things considered.

Have you thoughts on the idea of a commodity super cycle? I have a little exposure to copper (as I like the long term thesis of world electrification) and a little Uranium (as I think the supply demand relationship is interesting). But they just ain’t a pond I fish.

I’m mostly in software, e-commerce and Fintech.

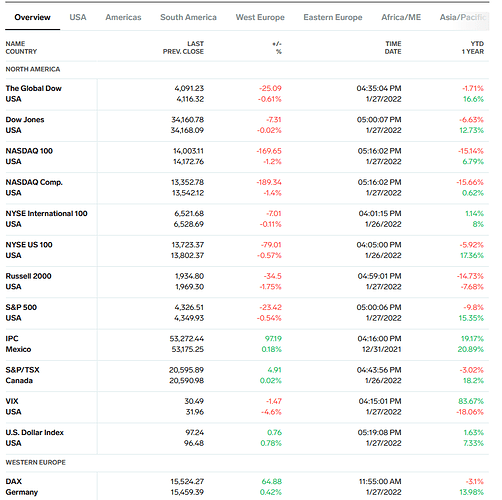

This is a very good read which may answer your questions. Not a perfect analysis as it mainly fixates on China and ignores other variables, but still.

Having said that, I have read that China intend to front-load a lot of infrastructure plans which should help prices in the short term. 3t Yuan in in the first 2 weeks of 2022 compared to 1.2t Yuan in 2021, for example.

Cyclicals will carry on as such and if you time them well and know which businesses to look for, you can certainly be rewarded. This “green” revolution we need will require a metric fuckton of resources. In an inflationary environment with labor shortages/supply chain issues/covid etc - there will be a lot of trouble bringing new supply online.

Just my 2c. Definitely not an expert by any means.

I think it’s about one year in 20 the market ends up less than it started(or 1 in 10, not sure of the exact stat but it’s out there to Google)

Either way the odds aren’t spectacularly in your favour as even a defensive strategy to go ALL cash.

We have pretty steep inflation and it’s not going away overnight, so cash is going backwards.

It’s probably though a good time to be a little bear like and have some cash on hand to buy in on a correction

There has just been such a run up in asset prices with ‘cheap’ money.

The thing is if losses start spiralling will you know when to buy back in?

I’ll be buying the S&P 500 again if it sees sub 4k. Otherwise I’m pretty happy to be paying down some debt so I don’t get squeezed in the next 2 years(so yeah a cash strategy I guess)

I’ll have a go…I actually used to work as a Resources Company Analyst, but this may seem odd: I don’t follow the space much these days.

Nevertheless, I’ll share a couple of charts from a spreadsheet that I update from time to time.

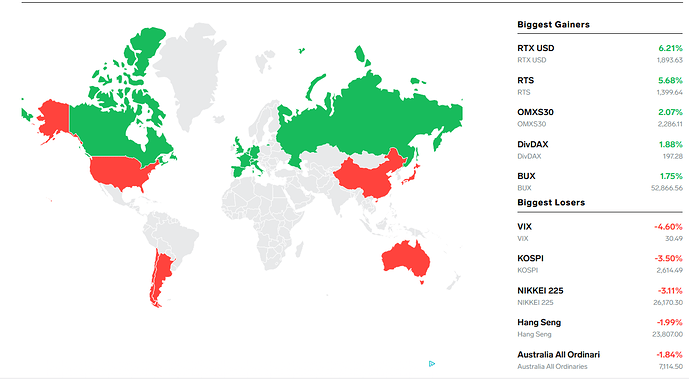

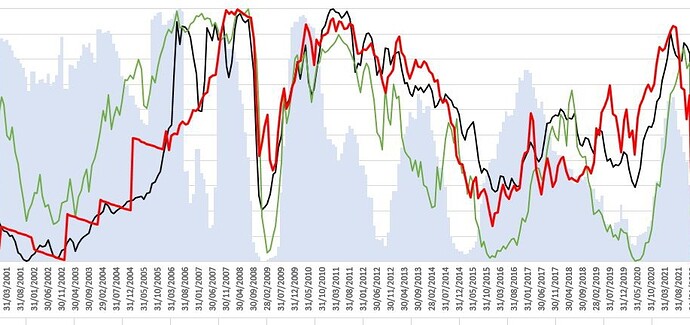

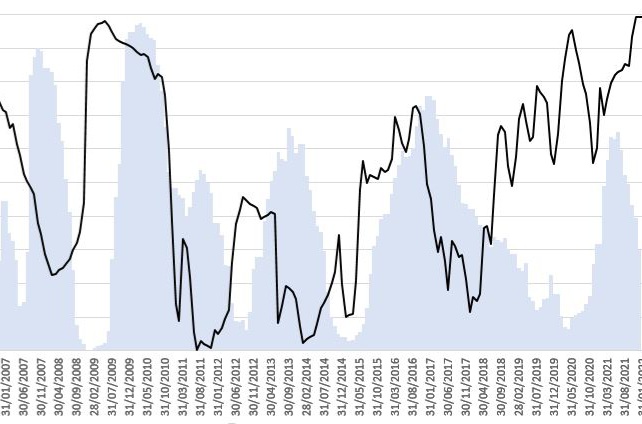

Chinese interest rates lead Chinese property sales

The black line is my inverted indicator for Chinese interest rates…the blue columns are my (smoothed, lagged) indicator for Chinese real estate sales…I think Chinese people see easing rates as a signal to buy property. But over the past year, the relationship broke down, as Chinese regulators leant on the developers to clean up their balance sheets. Buyers stepped away, and halted their property purchases until they had clarity on policy (eg. whether their developer would survive to complete their property!). So, if confidence recovers, and I suspect it will (eg. China did a RRR cut in December), then property sales should restart.

Chinese property drives the largest metals markets

Red is my iron ore price indicator…Black is copper…Green is aluminium…I think there is a lagged connection here to Chinese property sales, especially for aluminium (Buy AWC?).

Energy is a separate space

IMO, oil prices lead the space, and the community keeps consuming more, whilst trying to prevent the producers from extracting more…so I’m worried…because oil is a key inflation driver in my mind (probably reflecting my narrow working history), and I’m a bit concerned that the oil price will keep going up, such that interest rate rises are required globally to slow down consumption (of everything).

It’s going to be interesting what the green energy shift does to traditional fossil fuels.

The world has just had a massive economic shock caused by a shortage of coal. A coal production collapse in China pushed them to draw on global energy markets. That translated to gas and oil shortages worldwide.

Russia is using gas to blackmail Europe away from supporting Ukraine during any military attack.

From a national security perspective, fossil fuels are a massive liability.

EVs are becoming more and more prevalent around the world. Something like 8.5 million EVs will be built per year very soon. That’s going to impact petrol demand.

Solar and wind linked to battery storage and hydro are becoming a more cost effective short term electricity producer than gas. That’s going to reduce global gas demand over time.

My view is lithium and battery technology will grow massively over the next 10-15 years. Any grid scale battery tech that doesn’t use lithium will make an absolute killing.

I sold off in the Covid drop. I didn’t stick to my stop loss strategy and sold ones before they got there in the hope I cashed in on profits.

But after reviewing it, it was a major mistake. Had I stuck to the stop loss strategy, some of those stops wouldn’t have fired and I would have held onto them whilst it recovered.

Instead, I cashed in, paid capital gains on the sale and didn’t buy back in until later on (probably at a greater price to the sale).

Also, if you can find some stocks that are stabilising or going against the negative trend, then in theory these should hold your portfolio up a little during the down time and follow the upward trend later when the entire stock market recovers.

Yes that’s the big problem when the market drops. You need to know how to be a value investor to pick up the bargains,

At about 3500 for example the S&P 500 would have a Price to Earnings of 17. Which is the 10 year average.

Without doing a lot more research on individual equities I think that presents decent index buying logic.

Right now even after the shocking start to the year it’s still trading above 20 p to e at 4300 levels.

I still think there will be some blowout when companies like Tesla don’t deliver on promise, their valuation is just too high that when they bust they will drag other good companies down with them.

In a credit driven collapse people liquidate everything. So you gotta know what’s good buying at what price if you have some cash.(and be prepared to wear future short term losses as stuff can be oversold)

When the market tanked during covid i bought mostly etfs. and a couple of speccies.

You need to post here more often. Thread is a bit long aussie micro caps.

What are your thoughts on the breakdown of the china / copper relationship? Mid 2021 when china prop blew up and iron ore was down massively as a result, copper sailed through at over $4lb…barely a blip when historically it would have gone the same way as iron ore?

It hasn’t been a fun few months in high growth, however we have had very strong Qs from MSFT (especially their cloud division), AAPL, TSLA and software companies NOW and TEAM. Valuations for high growth have come down to pre pandemic levels where we had significant “pull forward” revenues but increased digitisation of the economy. If you want to make a bet on some of the most innovative, fast growing tech companies then you’re not going to get many better opportunities, valuation wise.

Nice to see some green last night, albeit not on great volume.

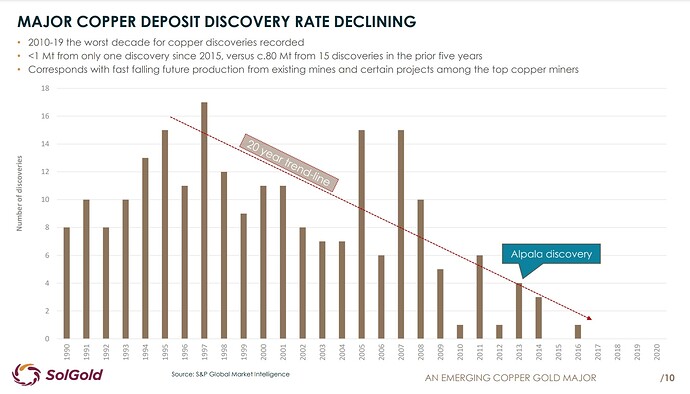

Copper probably is more of a global demand story, as it is required wherever electrification is occurring…I just went hunting for any recent comprehensive copper presentations, but couldn’t find the perfect one…but to select some slides:

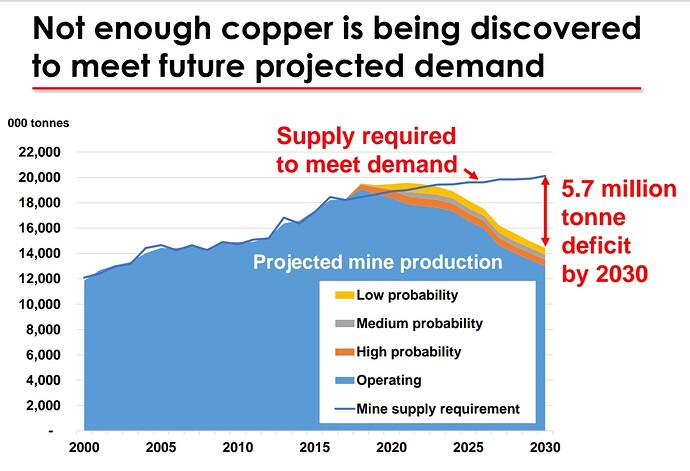

Copper is hard to find…and what copper can be found, isn’t in the easiest locations of the world (eg. South America where there is a lack of water, west Africa where there is a lack of safety):

The existing mine production does decay, as grade declines and the smaller mines are exhausted:

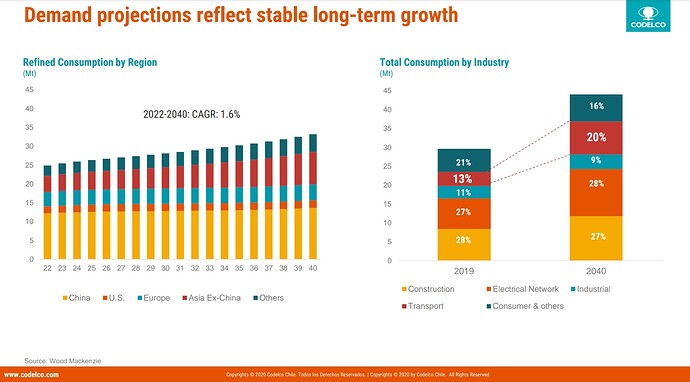

But demand is expected to rise relentlessly:

TBH…you can go down a rabbit hole, googling the corporate presentations by these copper explorers/developers/producers, but you’ll eventually form the picture (my search popped up all of BHP, RIO, OZL, Glencore, Codelco, Ivanhoe Mines, CRU Copper Day, Solgold etc).

My brother is an exploration geologist hunting copper. Massive shortfall in the pipeline of new copper production. That’s going to drive up the price of copper over the medium term.

Basically any producer with a reliable producing ore body will see a big bump to their profitability over the coming years. Any exploration company that hits a find that can be converted into a producing mine will make massive returns.

But exploration is a lottery. It’s a massive risk/ reward space to invest. Maybe 1% of exploration juniors make a find, the rest collapse.

I am long freeport for all the reason you highlight.

Demand can be pretty price inelastic as well…when supply gets tight…are you not going to build that motor, wind turbine, network etc because copper has doubled? Copper is probably a fraction of a percent of the cost of many of these things…you just pay the price to get it built.