At least this bear market might sort out the giant crypto ponzi market.

It didn’t take long for 2 crypto to shut up shop.

I think a lot of first time investors during peak covid/ lockdown either in the stock market or crypto are going to get burned a fair bit.

Jumped in expecting easy money, not sure they’d have fortitude to stick it out for the long run and happy to just take what they can now and cash out even if it means selling at a loss.

I’m probably going to start putting some money in once every couple of months here and there for the next year or two. Hope this will be a good opportunity to pick up some shares in quality companies/ ETFs at relatively decent prices to hold for the long term.

I’ve got a property on the market at the moment and I expect to take a hit due to the interest rate rises. On the other hand I’ll have cash to spend on a depressed stock market. Win some lose some.

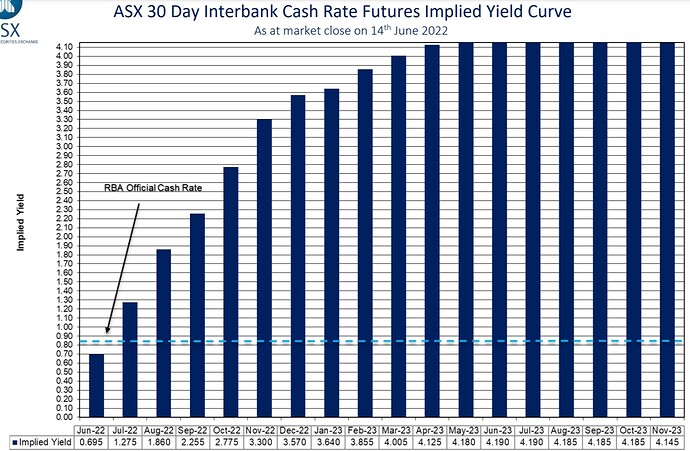

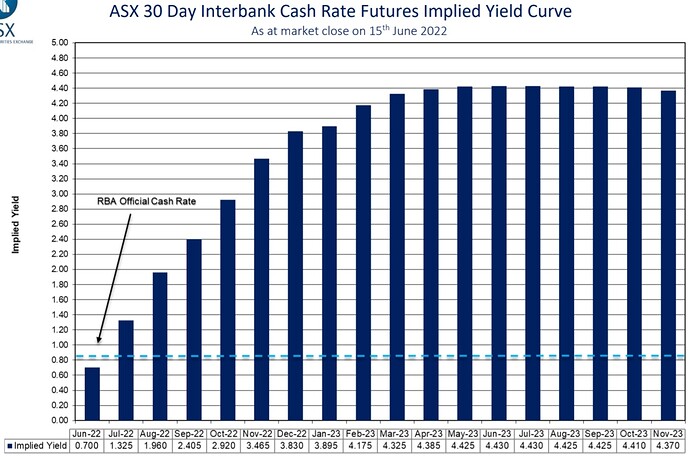

FWIW…that ‘hot’ inflation number in the USA last Friday has boosted our interest rate markets in sympathy…we’ve now cracked the “4% of rate rises within a 12 month period”:

I personally don’t think we get to this, because too many people blow up early in the journey.

Also happened to see Philip Lowe in interview on 7:30…no respect for him…I would unkindly translate his words as: “My past statements about no rate rises until 2024 were highly caveated, you just didn’t pay enough attention. And we can’t be blamed for what we said, because we can’t actually forecast the future - but let me tell you about my new forecasts…”

They should have raised rates much earlier.

Political imho. Was clearly required 12 months ago - a short 50 basis point hike would have done the trick.

But no…. “Transient” inflation.

What are your thoughts on building right now?

Material costs ATH. Labour ATH. Interest rates rising. Seems like a perfect storm for the whole industry to implode.

I am looking to build. Design is all done, but I’ve postponed the build phase for the moment. Within 6 months I’ve seen the building quote jump 30-40%. Ridiculous.

My concern is that the house gets built at the top of the market and when things drop/stabilise then my mortgage won’t reflect the state of the market.

I want/need to upgrade my car. So ideally not buying anything for a while.

Looking at getting a discovery 4.

I cant see cost of building dropping for a while, inflation is here and there are still shortages everywhere in the building industry.

Love Disco 4’s…Still think they’re the best cars LR has built (apart from the original 2 door rovers)

I guess the questions I would ask you and others would be…“would you be building in this climate?”

It depends if you have quality builder lined up, and know they will be able to get it to lock up stage without many interruptions / delays.

I know a few people who have decided to sell blocks recently due to the increase in land price and build cost, they are planning on selling main home and upgrade. Its hard though as you still want to move into a newer home. Also know a few younger people who have just finished building in last 12 months, and they love new home, and got in before all the building delays - price increases etc. And effectively House increased in price once finished by over 100k

The builder seems to be quality. Just need to piece a few things together at the moment.

I was considering selling my car (which has gone up 10k since covid) to add to the contingency and just buy something older in the meantime.

A month ago I reported in a conversation with an investment advisor to many of Melbourne’s very wealthy (typically aged 65 plus). They were waiting for the cash rate to go to 1% before doing any trading. They now are waiting for the cash rate to go to 2% before checking out the market. Any dividends received are sitting in cash with almost no buying and selling of shares unless they have to. They are still confident in the underlying economy. They have been nibbling away at long term debt as they believe the 10 and 15 year rates are too high but have been trading on a very short term basis so as to not get caught out. Besides they are bored and need something to do…

The issue the RBA faces…do they cause a recession (probably a given) and trash the housing market (something they would prefer to avoid)…or have a huge inflation problem. It all comes down to numbers…various ones…but much of the key (although obviously more complex than this) is:

recession and unemployment - impacts 5-10% of the population

housing decline 10-15% - maybe 10-15% of the population

housing bust 20%+ - maybe 20-35% of the population

inflation rampant = 100% of the population

In the past, the RBA has eased off…aware of housing leverage and concerns…this time they won’t be able to unless inflation gets under control because it impacts every single person deeply to the bone…

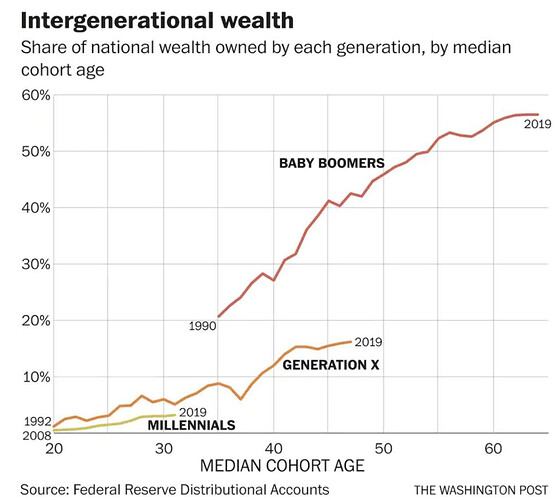

…so they will blow people up in the journey because it will be the least bad outcome…the upside is that there will be a generational reset on asset prices…which has been due for 25 year… or as many younger people would / should call it “■■■■ the boomers”

Where’s the chart on debt by generation?

How much of the boomers Wealth is tied up in bonds?

What’s the cause of this bout of inflation?

I was always of the view that the inflation was largely due to increased costs of production for consumer staples caused by covid logistical and operational restrictions. Buggered if I know anything tho.

I am not sure what you are after here.

1)You would want to be looking at net debt…or net assets…it is all largely with the baby boomers.

2) No idea, not a great deal percentage wise. The Aus property market is $10T in value, most wealth is in property and the share market

3) multiple factors, but largely supply side driven. Covid => production => logistic issues => end of just in time inventory => direct govt payments (goodbye trickle down economics) => Ukraine => whatever else

I’d argue that it’s fairly logical to assume debt to equity is much much higher for obvious reasons with younger generations.

Expensive debt is more likely to disproportionately cause defaults in the housing at least held by millennials and gen X

Further increasing the percentage of wealth held by boomers. Who may buy up on aggregate more property once yields improve as a place to park their retirement wealth sitting in other unproductive places.(eg cash, bonds, fixed interest with lower returns…typically older more conservative investors).

So the posters assertion of a recession levelling this up somewhat with a generational reset? I’m not so sure.

The only thing I think that would genuinely destroy asset prices is sustained inflation. Which could happen.

The RBA seem convinced they will take a bat to that though, which they had to do.

I’m ■■■■■■ off they didn’t move first. I hate following America.

I take your point on debt to equity % but i read your initial question as the dollar amount not the ratio.

You may be right that a property crash might disproportionately hit the yiunger generations…the rest ahould have happened decade or two ago…younger generations may wind up being the unfortunate ones dragged in at the top.

All that said, i am not saying a crash is coming…but i am saying the RBA won’t be catering to asset prices because inflation is a beast they must tame…and positive real rates is what they need to do…which currently is much higher than here.

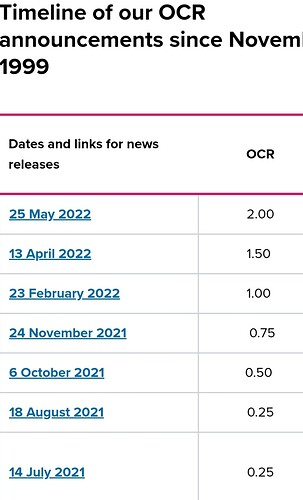

I just checked on NZ, because I was pretty sure they are ahead of us…I just learned something…

In March 2021, the NZ Government instructed their reserve bank to include house price sustainability in their considerations.

The RBNZ started raising rates in October 2021 and are already at 2%:

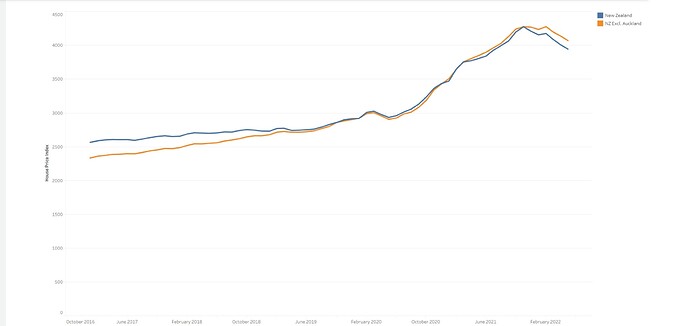

NZ property prices went into decline when that first interest rate rise occurred:

NZ is a bit of a test bed for Labor (ALP) econocrat policy I think. Bit of a divergence into politics but that’s what I thinks been going on if you pay close attention to a few of the things they have been doing there and what Labor’s been thinking here.

My daily check on the eye watering interest rate outlook. We’ve shifted up again, jeepers!

4.4% plateau now…so that’s ~3.5% of rate increases compared to today:

I guess the RBA governor did say yesterday that inflation might reach 7%, so an interest rate of 4.4% is still negative in a real sense.

If I look at the monthly increments…well the USA is now talking about potentially three consecutive monthly increases of 0.75% (first announcement due tonight)…Australia’s curve looks like five consecutive monthly increases of 0.50%.