Do you have figures for the preceding 3 years?

Edit. Not repayments but rates.

Still looks a long way south of their “long term average”

Note they have that same disease which caught on here at the turn of the century.

Just what did bankers do around the year 2000….

Wasn’t the bankers, it was the entire western world outsourced everything, with manufacturing going to China, Taiwan and Mexico. Services went to India, Poland and Phillipines.

Everything got cheaper so no inflation and minimal real wage growth. Hence central banks had to keep interest rates low after each recession to get growth going.

That same interanational economy got hit with covid, China and us trade war, limited immigration and now Ukraine. All those deinflationary systems have unwound at once.

I found another website. It seems to suggest the following…

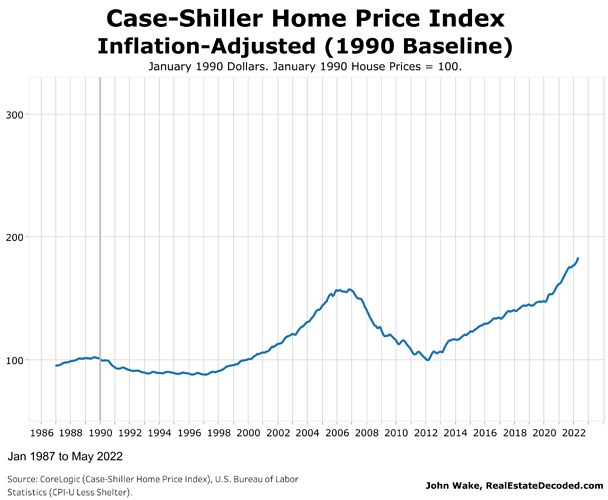

This property price history:

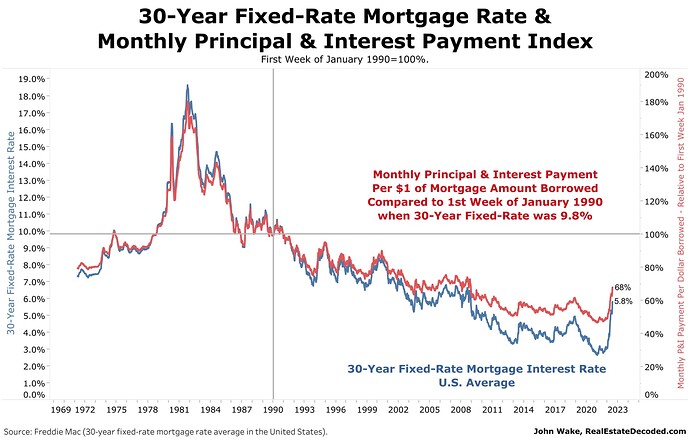

When combined with this mortgage rate history:

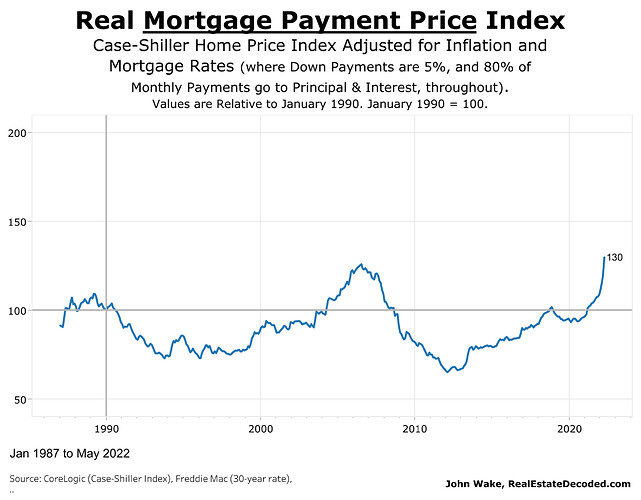

Produces this mortgage repayment history:

Vulcan seems to have been on a steady rise the last fortnight. Was $5.42 on 30/6, now $7.38

yep nice to see things have recovered a little

Uh Oh…I don’t know where to post this …anyway check out how the property market works in China

This is an absolute recipe for disaster as its set up like one huge pyramid scheme.

Public anger is growing over stalled projects, as many homebuyers had started repaying mortgages before they are in possession of the new property. In China, real estate firms are allowed to sell homes before completing them and use the funds to finance construction. It’s the [most common way] of selling houses in the industry.

The what’s next on the inflation picture is not a happy one.

6.1%. Feels spirally.

Question for the economics people. what happens say when business inflate prices to pay for increased debt burdens as well as customers cut back spending?

I mean how does raising interest rates combat inflation when the cause of the inflation to begin with is not all cheap money.(it never is totally cheap money, although there has been plenty of it)

I think we’re all ■■■■■■ is the technical term.

Increased costs = less discretionary spending = more small businesses going kaputski = increased unemployment = recession. Just depends how long it all takes IMO.

So this is where central banks are between a rock and a hard place. The inflation has been driven by a whole bunch of things inclsuing cheap money…which is a tap that banks can are are turning off. However there was covid helicopter money and masses of supply chain issues that have contributed as well. Central banks can’t do anything much about this supply cost push inflation…

…so they were all waiting and hoping supply chains would get fixed = increased supply = bye bye inflation…but it didnt happen and inflation got away from them. Now they have to raise rates to stop inflstion which means a big risk of breaking things…the economy and housing. For 40 years in Australia they have avoided this. If inflation doesnt moderate they wont have a choice but to break the economy by raising rates hard.

Why will they do this?

Simply put inflation impacts everyone. Break the economy and you get 10-30% of people in pain…housing , jobs etc. They dont want to do this…but it is the lessor of 2 evils.

Simply put again…countries dont riot and overthrow governments over falling asset prices…but they do over spiralling inflation costs…when you cant afford food, clothes etc…look out. Maslow’s hierarchy of needs.

As for your specific question…supply and demand intersect at price. Prices rise = demand falls…too high and businesses go bust…this is where we are heading if inflation does not come down.

The US will do 75bps of rate rises again tonight…we will have plenty more too

Isn’t shelter right at the bottom of Maslow’s hierarchy of needs?

Above clothing and food…and he didnt say you had to own it…just have it

I don’t see how rising rates decreases price of shelter though? It’s essential.

Or is the idea that the reserve bank wants you to spend less on everything except your dwelling, food, clothes if short. Where you have to pay more?

Maybe i didnt write it clearly but you some unusual takes on what i wrote. Google a supply and demand curve…pretend it is housing…rising rates reduces demand…the demand line moves…volume and price decline…as for central banks…you are over thinking it. Basically…they dont want to cause a recession…but they will if thye have too…not deliberately but as a result of getting inflation under control

Yeah but for any decrease in the ticket price of a home is offset by the increased cost of debt repayments.(most property is still purchased with debt and if not those with wealth have probably have seen it disappear on the equity markets)

And then with the decrease in ticket price of a home, more people delay purchasing a home(it will be cheaper tomorrow or I’m unsure how much more I’ll need to pay in interest on it)

That pushes more people into the rental market(as you say you don’t have to own it just have it).

Increasing the cost of rents.(more people renting)

(And rent afaik is included in the calculation of CPI? )

The only circuit breaker would then be a surge in unemployed and then homeless people sleeping rough eventually reducing the demand for rentals when enough are priced out?

Pushed out.

Or the rent vs buy equation make it attractive for more to buy property ?

Some solution to fighting inflation.

Wouldn’t there be better targeted fiscal solutions to fighting inflation?

Subsidising diesel to reduce freight costs.

Shrinking the public service -and pulling the immigration lever- conversely increasing the supply of labour in the private areas of the economy.(decreasing payroll costs on businesses providing essential goods and services)

Removing tariffs on essential products where applicable.

Etc

Especially because there’s been cheap money for so long. Any beneficial efffect of crimping demand through money supply won’t it be realised pretty quickly?(many people are highly leveraged)

As I understand it the price of homes doesn’t appear in inflation calculations. That’s because homes are an asset as opposed to an expense. e.g. food and petrol are costs that are in the basket of needs that they use to calculate inflation; houses and cars are not. Not an expert but that’s my vague understanding.

Price of housing affects the price of rent, so upwards housing trends logically should impact cost of living.

I’ve no idea how or if they factor that in.

I don’t think they do. The CPI figures are more of an economic guide than a real life measure.

You need to think of it in terms of supply and demand…so for housing…yes, those things are at play…and what is the supply (no over supply in Aus) so it becomes a bit more marginal. We don’t often see massive declines in house values as you really need to see high unemployment = forced selling = increased supply + lower demand = lower prices.

The US 2008/09 was huge because there was millions of units of excess supply…we don’t have that.

You are correct on the fiscal policies…but the last government was inept and the current one has inherited massive debt levels which make some things a bit tougher to achieve even if they wanted to.

The big issue is much of this is out of our hands.

*LVL timber was coming from Russia = decreased supply = higher prices…getting better now

*Inflexible labor…staff shortages everywhere. Stop / Go sign holders making up to $100k a year…dishwashers at $80 / hour…none of this is sustainable for business…

*China zero covid policy…massively disrupting all supply chains…not changing any time soon

- Energy supply will continue to have issues globally

You are right…increase the labor supply…we should be offering 250k backpacking working visas to get casual staff back in…250k visas to tech / graduate students to get new industry growth going

So the end situation is…central banks have a few tools…not the right ones…so they are forced to get prices down by moving the demand curve not the supply curve…it is a very blunt instrument.

They will do it though because inflations trashes 100% of the population…esp. the poor and elderly so if they hurt the economy and housing it will simply be an unfortunate side effect.