Just picking up on what @Dons1984 has said about the lack of detail making it hard to predict what effect the changes will have.

I think the real test will be the detail of the mandatory pre-commitment levels.

Tasmania announced changes last September where players will need to set a mandatory loss limits of up to $100 a day, $500 a month and $5,000 a year. These changes aren’t due until end of next year so we don’t yet know what kind of drop that’s had on gambling figures. We also don’t know what limits Victoria plan on introducing, other than not being able to load up a machine with more than $100 - will that be the total daily limit or just on a single machine?

So what do we know?

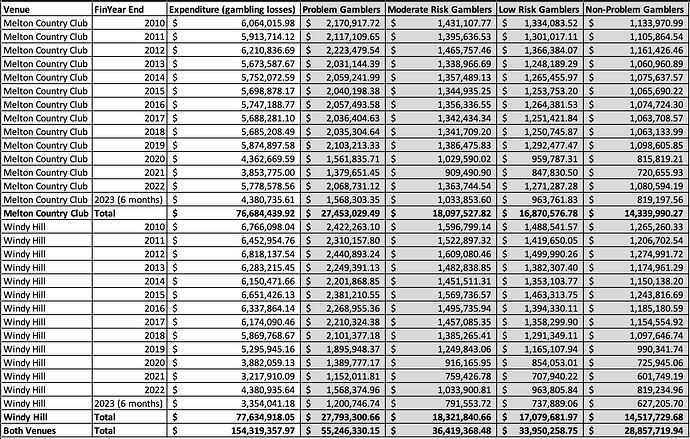

According to the Social Cost of Gambling to Victoria report (2014-15), it is estimated that 35.8% of gambling expenditure on pokies in Victoria is from problem gamblers and a further 23.6% from moderate-risk gamblers. Only 18.7% is from non-problem gamblers.

For context, the Gambling Activity in Australia report (2017) finds that 58.5% of people who play pokies are non-problem gamblers and 6.3% are problem gamblers. So those 6.3% of people are contributing 35.8% of the money that goes into pokies. The 58.5% of people not at risk of gambling harm only contribute to 18.7% of pokies revenue. This should come with caveats around not knowing if the two reports are using the same methodologies to classify problem gamblers, one report is Vic only and the other national, but it’s at least useful to base a loose conversation around.

There’s also problems applying the problem gambler expenditure numbers (from the social cost… report) across the board, as it would fluctuate by LGA and by venue, but I’m going to do it anyway for the sake of argument but just keep in mind the figures in grey are not official. The expenditure data is and can be found here.

So a good mandatory pre-commitment system with low loss limits, like what was announced in Tasmania, can be expected to impact a smaller group of people (problem gamblers, some moderate risk depending on their behaviour) however it can drastically limit their spend - I’d need to find a source but I’ve heard it said mandatory pre-commitment could cut gaming revenue by up to 30% (** checked source and it was a regularly used industry number in the 2010 productivity commission inquiry into gaming/mandatory pre-commitment)

From past experience working in venues, problem gamblers don’t often contribute a whole lot in terms of food or drink sales so I don’t imagine that revenue stream being touched much.

From the 2022 Annual Report Essendon made $3.37m profit from their two venues.

| Revenue |

|

| Venues revenue - sales of food & liquor |

$4,060,076.00 |

| Venues revenue - other |

$9,265,801.00 |

|

|

| Expenses |

|

| Venues expenses |

$9,955,693.00 |

|

|

| Total P/L |

$3,370,184.00 |

Both venues are open 8am - 3am most days. I don’t know if they’ll be able to change to 10am-4am so that they only lose one hour - Can’t imagine councils would be too willing. If not, you could probably bank up to a couple of hundred grand in staff costs across the two venues. I’m not sure what other drop in expenses there would be?

Between Bacchus Fox’s estimate of a 10% reduction in gaming revenue and my higher 30% number the profit from the operations of the two venues could drop from $3.37m to anywhere between about $600k - $2.5m.

I’m a member of NoPE but this is very much just me thinking aloud here rather than a position of ours and as stated, most of those numbers come with caveats but act as a point for discussion.