Trump obviously.

Crazy radical left, obviously. And Soros

Which the Feds can’t use for protection against imports or revenue raising to offset income tax concessions.

Also, retail sales taxes don’t discriminate between imported and domestic product ( National treatment principle of internal taxes and regulation of like products).

Reportedly, some Canadian Province has removed Tesla from eligibility for rebates on EVs.

Which the Feds can’t use for protection against imports or revenue raising to offset income tax concessions.

The main thing it will offset is newly-created subsidies to fix all of the problems that are created, like last time around… if, of course, the intent is to improve the bottom line.

Hint: that’s not the intent.

I’m not anti-tariffs by default as I’m not 100% pro free trade or economic globalisation - or at least I would like the negative social and environmental impacts to be addressed. Of course, that motivation is not on the agenda.

There are some good arguments in this thread for explaining why trump has imposed tariffs -

- to incentivise US-based manufacturing

- politically motivated to appease the swing states

- Trump loves a weapon to bully with and this is his economic gun.

The negative impacts on global GDP and the overall reduction in global ECONOMIC wealth are real. I think we need to stop repeating the obvious ie Trump’s an idiot, as there must be other smarter folk designing and implementing US economic policy. What matters is why are they implementing a policy that will reduce economic wealth and what will it achieve for Trump, his backers and the US?

Trump is mainly about wealth, but he’s also about power and ego.

I think he wants to rule the world and be the greatest US president ever. He can’t, but he can disrupt the world, and he’ll recast disruption as great change. At a personal level I think he’s that scorpion that stings the turtle when crossing the river so they both drown.

Fundamentally, there is nothing wrong with growing the USA’s self sufficiency by growing local industry. I just don’t believe successive US administrations will stay that course and that consumers will wear the pain, and I don’t believe this is the primary objective of tariffs for reasons explained on here by others.

I don’t know why a republican govt would follow this economic path, but maybe those of you who understand Project 2025 and the radical agenda have a better idea?

The dynamics at play here are wild.

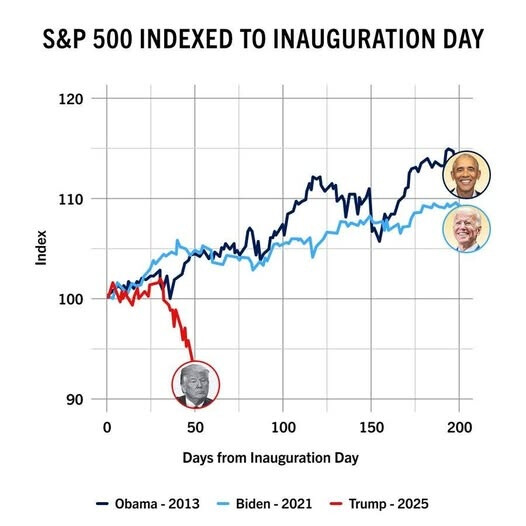

Some argue Trump is playing 4D chess to tank the economy to reduce yields to ensure they can rollover their maturing debt at a lower rate.

But tanking the economy also mean higher unemployment, lower tax receipts and likely a higher deficit. If they cut spending too much it exacerbates the recession.

If they do manage to get lower yields and lower the cash, that would likely lead to a lower USD and that would likely revive inflation, and would then mean they need to raise rates again.

All this is assuming minimal impacts from trade wars, geopolitical tensions and the strength of the global economy.

Some of it is a reaction to thinking inside the (Washington) beltway , with government and the Administration captured by all those clever people in think tanks who haven’t been exposed to real life experience. No one else gets a look in.

. It finds reflection here with Morrison’s Canberra Bubble accusations, Dutton anti bureaucracy (Drain the Swamp) , anti Woke etc.

As to Trump, it’s a reaction to him not belonging to the establishment elite in Washington and NYC, a vulgar carpet bagger against old money ( The Great Gatsby)

It’s a Counter Reformation in US economic and trade policy, also social policy and structure.

ADD

Reaganomics is on its deathbed and the Chicago Boy economists are on the dole.

https://www.visualcapitalist.com/ranked-the-top-20-countries-holding-the-most-u-s-debt/

LOL, Luxembourgh and Cayman Islands 4th and 5th…

Reportedly, some Canadian Province has removed Tesla from eligibility for rebates on EVs.

Nationwide, Tesla have been reporting some very suspicious sales figures.

BC said they’d end rebates on Tesla, but other EVs were still eligible

And another scam: the “Melania” cryptocurrency. $13,000 invested 6 weeks ago is now worth $670. The First Family that scams together… umm, well they haven’t actually stayed together, so … grifts together.

think Trump believes and hopes there are big profits being made and these companies can absorb some of the tariffs a

Does he also believe in the tooth fairy and Essendon winning a premiership being possible?

Can we put a tariff on Canada for Andrew McGrath?

It would miss the target

the ones who think the key to winning elections is to get republicans to vote for you

I heard the same arguments here over many years. in USA it is much simpler, you need to get people to actually vote.

But it is a consumption tax(a tariff)

It’s just levied along the supply chain

Incorrect. A consumption tax or GST by definition is a tax on the end user ie a GST ie when the good is consumed/used by the end user. A consumption tax is paid on the last transaction eg retail price. A tariff is not a consumption tax.

A tariff is incurred when goods are imported into a country. A tariff is levied on the landed cost of goods when the goods enter the country. Once a tariff is paid and the relevant goods leave customs, the goods might be on-sold a number of times before they are finally consumed or used by the end user.