It’s gone downhill badly since Hutchy acquired the station. Rarely listen to it, they way Ox, Mark Allen and KB were sacked was pretty ordinary IMO…

He was furious about the way we handled Sheedy, but he didn’t officially stop supporting us until after we sacked Knights and hired Hird.

That’s when he jumped ship to Richmond.

SEN founder Craig Hutchison’s media empire faces big test after market sell-off

9:06PM AUGUST 13, 2023

On the face of things, former journalist and latter-day entrepreneur Craig Hutchison fronts one of the fastest-growing media empires in the country. Barely a week seems to go by without the detail of the latest Hutchison acquisition of a radio station, sporting team or a new talent for one of his shows.

But amid all of Hutchison’s wins that generate plenty of publicity in the Melbourne media, there have also been some very real losses in recent months.

The most obvious has been in the share price of his ASX-listed company, Sports Entertainment Group (SEG), where Hutchison is CEO and major shareholder, which has dropped to all-time lows of 18c over the last fortnight.

Indeed, in the last year, the market value of SEG – which holds all of Hutchison’s key media assets, including 69 SEN (Sports Entertainment Network) sports radio stations in metropolitan and regional areas across Australia and New Zealand, sporting teams (most notably men’s NBL basketball powerhouse, the Perth Wildcats), a talent management agency and a TV production business – has dropped by close to 36 per cent, from $75m to just over $48m.

Hutchison is one of the most recognisable faces in the Melbourne sporting media, because of his background as a high-profile print and TV journalist, amid the growing profile of SEN.

When The Australian contacted him about the share price fall last week, he made it clear he believed there was “undiagnosed value” and “blue sky” in the brands established by his listed company.

“We’re builders, and we’re actively looking to build the business,” he told The Australian. “Given the global valuation of sports teams, I believe there is a significant amount of undervaluation of our teams strategy. We’re being built for a bigger, broader day.”

But some obvious growing pains are evident. SEG’s share price fall to 18c came soon after the company quietly disclosed, in June, a downgrade in its pre-tax earnings for its forthcoming full-year results this month, in the fourth paragraph of a “FY23 Company Performance Guidance”.

“The significant investment (costs) of establishing new assets in Sydney, Queensland and particularly New Zealand is a key driver of the decrease in underlying EBITDA on the (previous corresponding period) and our previous guidance,” the ASX update stated.

However, the company also shed a positive light on that blip: “We expect the operating cost base in both the Australian and New Zealand segments are now largely normalised, providing the opportunity for operating leverage as revenue continues to grow.”

The company’s note to the ASX came in the wake of its half-year earnings result in February, which saw a $1.96m bottom-line profit for the same period a year earlier turn into a $1.16m bottom- line loss, as well as a $10m blowout in debt to $21.7m.

The company, however, claimed the rise in debt was not of concern: “SEG remained in compliance with banking covenants during the period. $3.2m of undrawn funds remained available as at December 31, 2022,” the company stated.

Hutchison told The Australian that the company’s phase of rapidly expanding the SEN radio brand through acquisition and debt was now complete.

“Our house is built now in audio,” he said. “The footprint of our Australian and New Zealand stations and audio distribution is complete. It’s a really valuable future network across sport and racing that we look forward to extracting value from for years to come.”

The radio network’s revenue staple is seen to be the explosion in sports gambling advertising in recent years. But advertising still needs listeners, and Hutchison will be looking to improve the network’s current ratings. In the latest July radio ratings survey, there was a wide variation in the network’s listenership – from a battling 0.5 per cent in SEN 1170 in Sydney (where SEN took over the former music station 2CH in 2020) to 0.8 per cent for SEN 693 in Brisbane and a more respectable 3.1 per cent for its flagship Melbourne station, SEN 1116, which features as its star Gerard Whateley.

Despite its rising debt, the company continues to be on the hunt for new opportunities. Late last month, it was announced that Hutchison had won the race to take over the Melbourne netball licence dumped by Collingwood in May, reportedly because it was haemorrhaging money.

The as-yet unnamed new team – to be based in Melbourne’s southeast – will be Hutchison’s first move into netball, to accompany his four basketball franchises in Australia and New Zealand.

Hutchison believes that despite Collingwood’s struggles, the Melbourne netball franchise is a “fantastic opportunity” to build on his growing teams business. “It will be our first of many moves into netball,” he said.

Despite the doubters, Hutchison has a seemingly unshakeable belief that the market will eventually understand the value he sees in the company: “We’re an amalgamated whole-of-sports solution business: we’re in audio, video, snackable content, podcast franchises, production services, talent management and owning teams. And we’re committed for the long term.”

The ASX doesn’t understand me.

Does he actually listen to himself.

The article Furry posted is an earlier one from August. This is the full current article…

Craig Hutchison’s sports and media empire on the ropes as directors, auditor sound alarm

ByCalum Jaspan

November 14, 2023 — 12.27pm

Craig Hutchison’s media and sports empire is at serious risk, as company directors and auditors warn about his group’s ability to survive if it does not find a cash injection or new investors in the next nine months.

The journalist-turned-media executive’s Sports Entertainment Group (SEG) has a growing suite of assets, including SEN Radio, a TV production company, the Perth Wildcats and headline talent including Gerard Whateley, Kane Cornes, Matty Johns and more.

Yet after reporting a $9.3 million loss in FY23, the pressure on the business has increased**,** with much of its debt due in August next year.

SEG insists it remains a going concern, pointing to positive cashflow and improved trading.CREDIT:SMH/THE AGE

The group has only $1 million left to draw down on from its $28 million credit line from Commonwealth Bank of Australia (CBA), according to its most recent set of accounts.

A director’s note in its annual report, released in late October, stresses the business’ status as a going concern is now a “material uncertainty” after it breached bank covenants relating to its loan, and remains dependent on the CBA not calling for repayment immediately.

Loading

The matter was also acknowledged by auditors, BDO, who drew attention to the notice that it said, “may cast significant doubt about the group’s ability to continue as a going concern” and “realise its assets and discharge its liabilities in the normal course of business.”

“Our opinion is not modified in respect of this matter,” BDO wrote.

However, SEG insists it remains a going concern based on several factors, including positive cashflow, forecasted improved trading performance in FY24, and completion of its acquisition and investment strategy.

The company is now seeking fresh capital, pitching to high-net worth private investors, in an attempt to reduce its comparatively large borrowings before the deadline, according to multiple sources with knowledge of the process not authorised to speak publicly.

The company’s filings state it is evaluating options for raising additional capital, which it says would assist in reducing borrowings.

Hutchison, who declined to comment when approached by this masthead, joined SEG as chief executive via a 2018 merger with his own sports content business, Crocmedia, and the company’s fate is deeply tied to him.

He is also on-screen and on-air talent for his Sports Entertainment Network – for which he is separately paid $550,000 annually – and is the company’s second-largest shareholder.

Between chair, Craig Coleman (also co-founder and managing partner of SEG’s largest shareholder Viburnum Funds), fellow alternate board director Ronald Hall, racing analyst for SEN, John “Dr Turf” Rothfield and Hutchison himself, sits 59.2 per cent of the share register.

Hutchison with leading SEN broadcaster Gerard Whateley.

Sports Entertainment Group has a uniquely diverse set of assets, including 65 radio stations across Australia and New Zealand, a TV production company (Rainmaker), a portfolio of five sports teams, broadcast rights to almost all major sporting codes (AFL, NRL, Test cricket and Big Bash League, NBL, both A-Leagues and the Australian Open), the AFL Record and digital racing brand and network, SEN Track. The latter is a cash cow for SEN, described by a current employee as a “juggernaut”.

Since 2018, Hutchison has led an acquisition offensive to build the above assets, spending $46.7 million in the process. His latest deal will see the company own the eighth Super Netball Licence in 2024, unveiling the Melbourne Mavericks. The licence went to market after the Collingwood Magpies, the nation’s largest sports club, closed its netball operation after chief executive Craig Kelly deemed it unsustainable.

While Hutchison is steadfast in his plan to build a specialist sports media business, his strategy has perplexed some, particularly the move into participation-led sports such as basketball and netball, with the latter facing serious financial woes.

The Perth Wildcats are one of SEG’s sports teams.CREDIT:GETTY IMAGES

One senior industry executive called some of SEG’s recent acquisitions “questionable”, while another said its combination of assets was “complicated”. Both spoke anonymously due to personal connections to the company and Hutchison.

After details of the loan and results attracted unwanted attention, Hutchison responded on his own SEN radio show, Off the Bench, saying the company was in good shape.

“We are an incredibly strong business, we’ve never been in better nick,” Hutchison said, despite adding that the company “would have liked to have done better”.

Loading

Questions remain though over SEN’s ability to impose a national footprint, with its Sydney and more recent Brisbane radio networks struggling to cut through, unlike in Melbourne where it’s buoyed by a footy-obsessed market led by AFL media darling Gerard Whateley.

The main network collects a 3.1 per cent share in Melbourne, compared to 0.7 per cent in Sydney and 0.9 per cent in Brisbane.

It also has lucrative deals with several bookmakers, producing in-house content and shows for Ladbrokes and Neds, while its content provides fertile ground for wagering firms to sink millions in advertising targeted at SEN’s hard to reach, male-heavy demographic.

This too though is on an uneasy footing, with the future of advertising from the sector leaving revenue for SEN and all media companies in limbo, a risk company directors also flagged to investors.

Nine Entertainment, the owner of this masthead, owns a 3 per cent stake in SEG via 3AW.

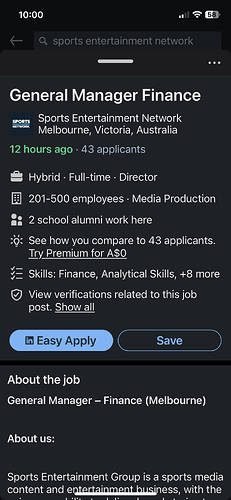

Is one of those other 8 listed skills “digging corporations out of the ■■■■”?

Wait, on LinkedIn it’s all corporate wank speak. I guess that translates to “creative accounting”.

About us:

Sports Entertainment Group is a sports media content and entertainment business, with the biggest load of ■■■■■ media outlets in the industry. We strive to push our unconscionable partnerships with evil betting agencies down our listeners throats, with minimal content sprinkled in between. We aim to bore our listeners with braindead commentators like Tim Watson, and love nothing more than to churn out low rate content with minimal effort.

oh man that’d be the easiest gig in the world

- buy some legacy asset

- trumpet acquisition of asset through other business assets

- cause short spike in value

- leverage more debt based on the new value

- buy some other legacy asset

- repeat for three years

- quit and let some other loser take the fall

Problem is Step 1 to 6 has allready happened, the new person will be the loser.

Just let the whole station burn to the ground

if boomers and proper nuffies dont have talk back radio what will they hav?

Comment sections in the Hearld Sun, or Facebook

retail workers

Those poor checked out teenagers

Cleary v Morris in the boxing ring when?

Must attend every Western Bulldogs post match presser.

Only thing I liked was Fine’s final siren especially when FC Coll or Richmond lost