After more than two years of the pandemic, floods, fires, political unrest and now war, there are fears the world is at risk of falling back into recession.

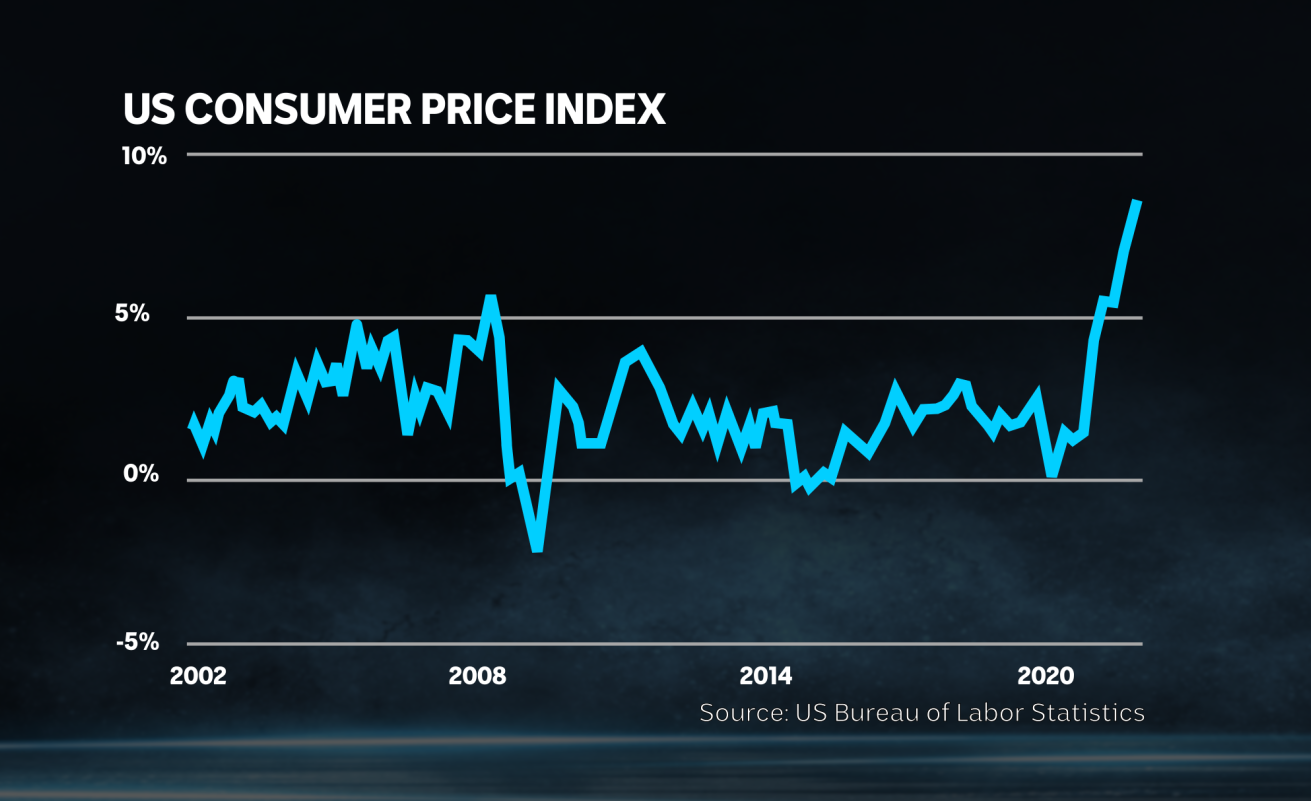

Inflation is the key issue.

Figures out this week from the US show it’s getting worse, not better.

Consumer price rises keep accelerating, with the headline figure hitting 8.5 per cent for March.

The US Consumer Price Index is at its highest level since the early 1980s.(ABC News: Alistair Kroie)

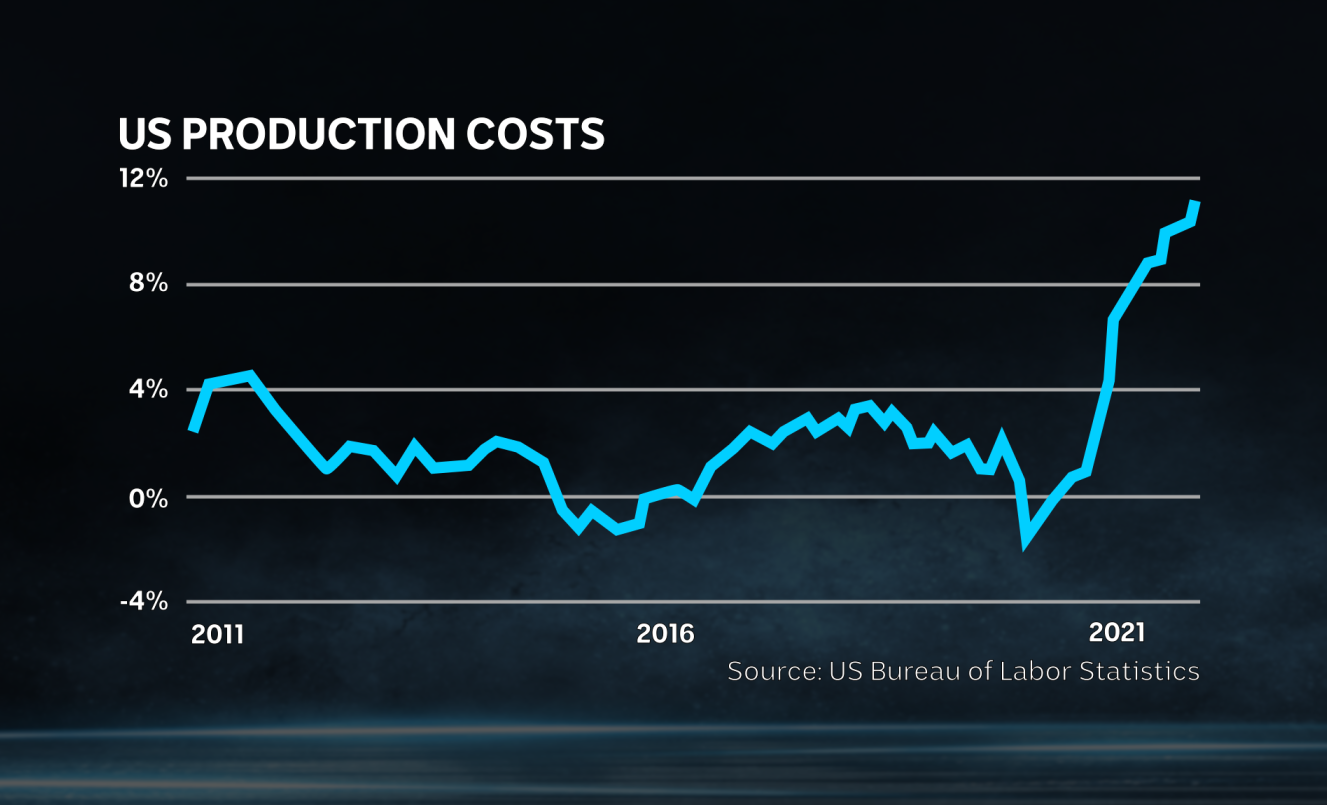

And those price pressures show no sign of abating soon, with the cost of production rising by an even faster 11.2 per cent.

The US Producer Price Index is recording a surge in the cost of production inputs for US businesses.(ABC News: Alistair Kroie)

That means there’s the likelihood of even faster consumer price rises ahead, as the providers of goods and services look to pass on their increasing costs to end users.

Russia’s invasion of Ukraine hasn’t been helping. As the war drags on, it’s continued to push up the price of oil, wheat and other major commodities.

But even before that, prices were surging as pandemic stimulus stoked demand while COVID disruptions hit global supply chains.

China COVID contagion?

And that could soon get even worse.

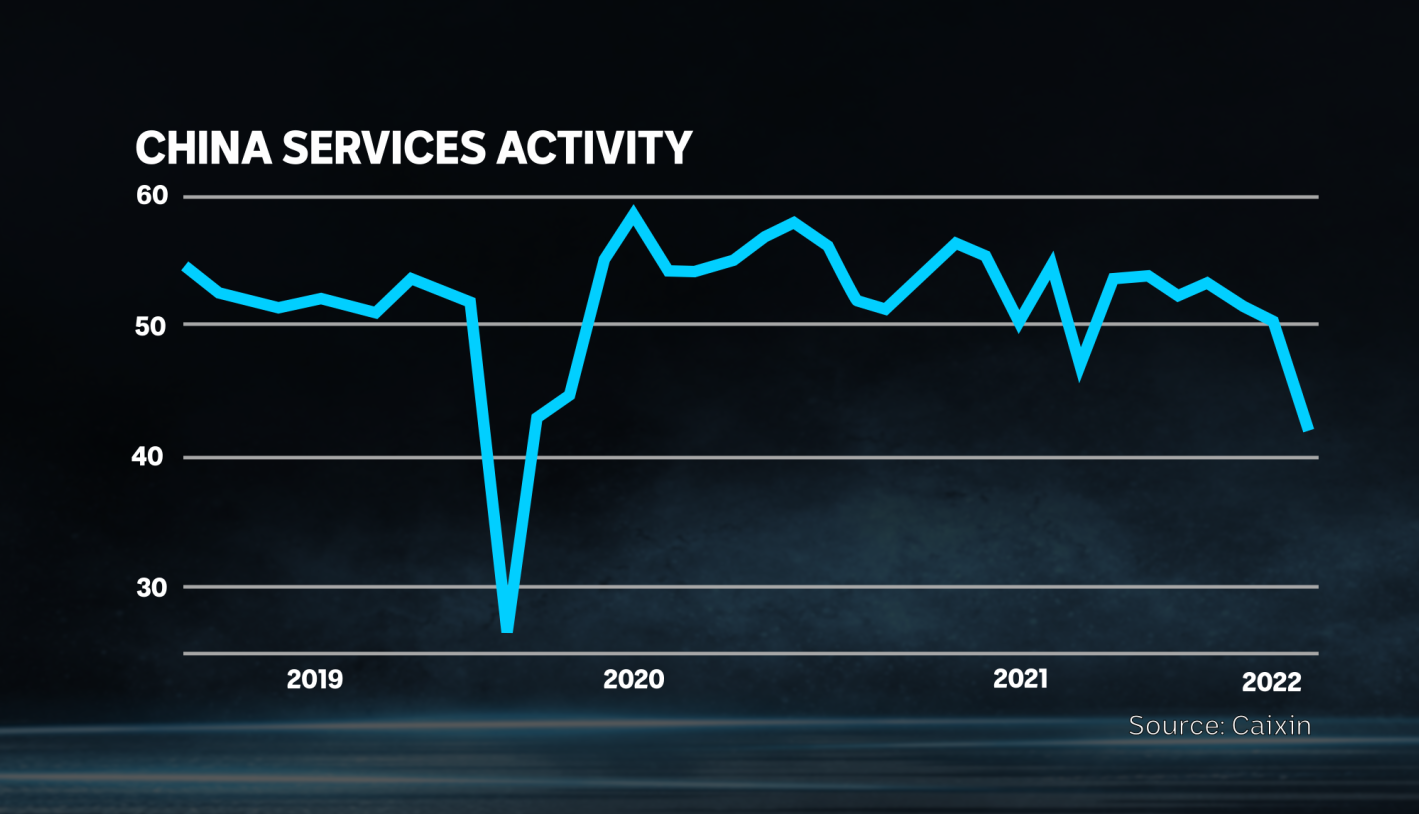

COVID cases in China are surging, with hundreds of millions of people living under restrictions, including millions under full lockdown.

The economic effect of those lockdowns is already being felt within China, as the services sector takes its biggest hit since the pandemic first emerged in Wuhan.

Caixin’s services PMI had its biggest drop since the original wave of the COVID pandemic originated in Wuhan and locked down much of China.(ABC News: Alistair Kroie)

“The high-frequency data that we track suggest that conditions have deteriorated further so far this month,” note Julian Evans-Pritchard and Sheana Yue from Capital Economics.

But, even though some factories have shut and Shanghai’s massive port has seen some disruptions, manufacturing and exports have been largely immune from a serious drop … so far.

Caixin’s China manufacturing PMI index eased in March, but not by much.(ABC News: Alistair Kroie)

“The situation has worsened since the start of April, however,” the Capital Economics analysts add.

"This is most evident in the logistics sector, where increasingly strict rules on intercity travel have disrupted trucking capacity.

“The daily flow of freight vehicles along highways has weakened sharply since the start of the month.”

While those analysts are optimistic that China is getting on top of its latest outbreaks, it does beg the question of what will happen next time.

‘Freedom isn’t free’: Why inflation may linger

Central banks had resisted raising interest rates last year on the belief that inflation would be “transitory”.

No longer, as just this week the Bank of Korea, Bank of Canada and Reserve Bank of New Zealand all lifted rates, the latter two by half a percentage point.

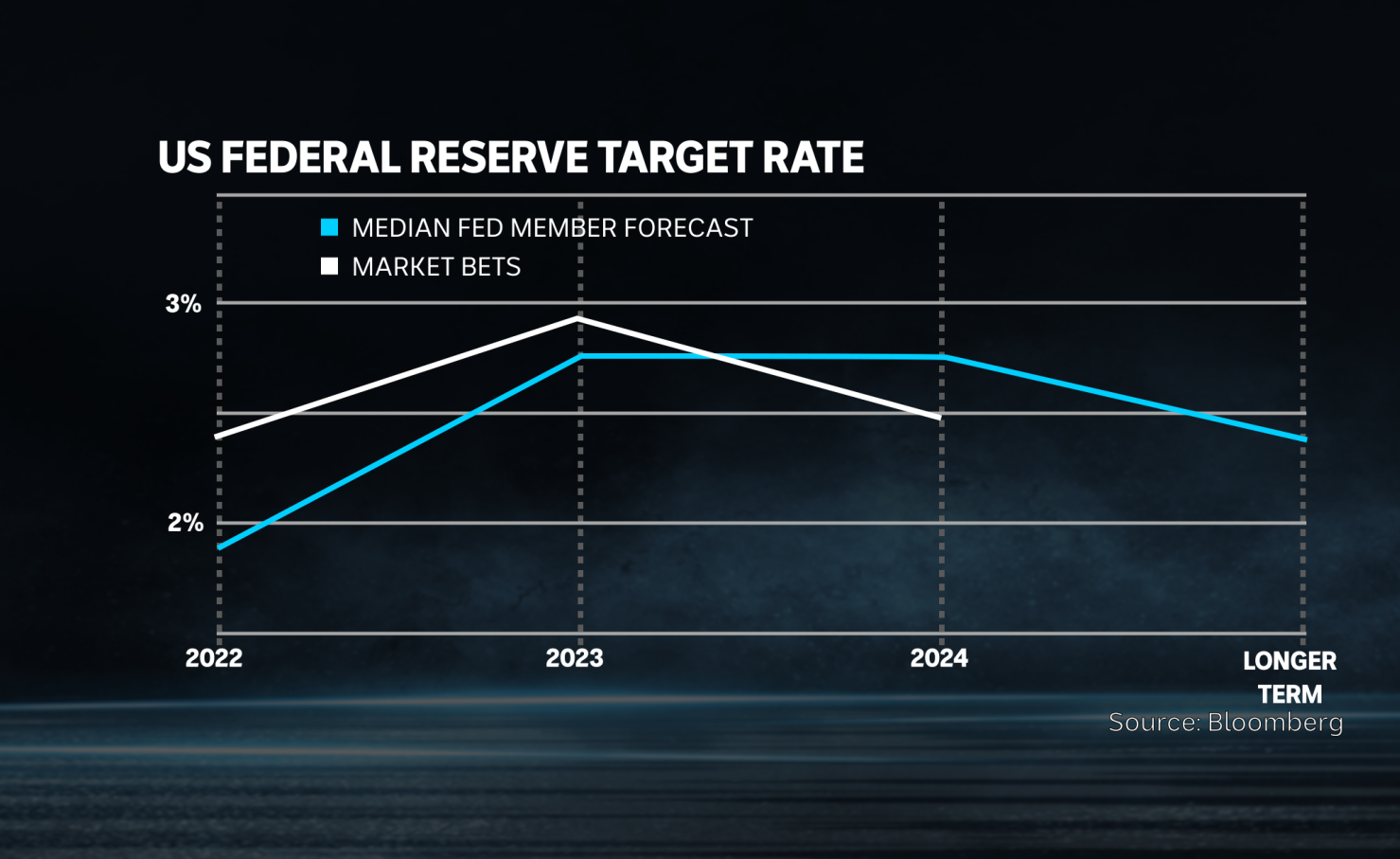

After a 25-basis-point rate rise to start, Fed members expect to hike rates more rapidly, at least for the next year or two, and traders expect rates to rise even faster than the officials do.

US Federal Reserve committee members expect to raise rates rapidly in the next year, but market futures pricing suggests even steeper rate rises.(ABC News: Alistair Kroie)

Investment strategist Gerard Minack says, “this is a classic case of generals fighting the last war”, with a “mad scramble” of central banks playing catch-up after inflation has surged out of control.

Even though many have started fairly aggressive rate rise cycles, most officials still expect (or at least hope) that inflation pressures will ease off quite quickly as supply constraints ease and rate hikes bite.

Gerard Minack broadly agrees with that view.

“What we’re likely to see over the next 12 months is some of the transient factors that really boosted inflation reversing, that’ll give spending power back to consumers,” he tells ABC’s The Business.

Space to play or pause, M to mute, left and right arrows to seek, up and down arrows for volume.

WATCH

Duration: 7 minutes 48 seconds7m

Rising interest rates and China lockdowns risk a global recession.(Michael Janda)

Although not all analysts are convinced that will be the case.

Rabobank’s Michael Every warns that the supply chain vulnerabilities exposed by both the COVID pandemic and Russia-Ukraine war will keep pushing prices higher, especially if geopolitical tensions remain high.

“We will soon grasp that freedom isn’t free,” he argues.

"It’s expensive, because if we don’t want to be economically reliant on the likes of China, then we need to be onshoring an awful lot of production.

“In short, today we have entrenched inflation, a Fed prepared to ‘meticulously’ ensure it becomes unentrenched, and a geopolitical backdrop that favours decoupling, which cannot be anything other than inflationary.”